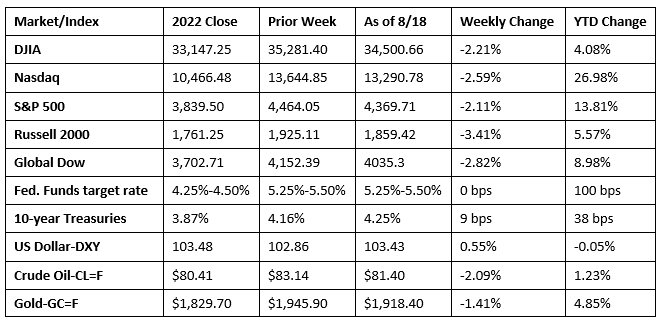

After another week of strong economic data, investors seemed to accept that the Fed may not be done lifting interest rates after all — and that Wall Street might have started celebrating the end of the rate-hike cycle too soon. Each of the benchmark indexes listed here dropped more than 2% by the end of the week, as did crude oil prices. Gold prices also fell, while the dollar advanced. Yields on 10-year Treasuries continued their upward march, reaching 15-year highs.

Tech stocks rebounded last Monday, pushing the Nasdaq up 1.1%. The S&P 500 advanced 0.6%, and the Dow inched up 0.1%. The Russell 2000 ticked down 0.2% while the Global Dow declined 0.4%, likely impacted by the growing level of concern about China’s troubled real estate market. The 10-year Treasury yield ended the day higher at 4.18%. Crude oil and gold prices dipped, but the U.S. dollar was little changed.

Equities fell across the board on Tuesday, with each of the benchmark indexes — and all 11 of the S&P market sectors — suffering losses. The Russell 2000 declined 1.3%, followed by the S&P 500 (-1.2%), the Nasdaq (-1.1%), the Dow (-1.0%), and the Global Dow (-1.0%). It was the first day since May that the Dow, S&P 500, and Nasdaq all fell more than 1%. A strong retail sales report helped drive up the 10-year Treasury yield to 4.22%. Crude oil and gold prices fell, and the dollar was flat.

Stock prices continued their retreat last Wednesday, after the minutes from the most recent Fed meeting revealed that committee members are divided on whether more interest rate hikes will be needed to knock down inflation. The Russell 2000 declined 1.3%, followed by the Nasdaq (-1.2%), the Global Dow (-1.0%), and the S&P 500 (-0.8%). The Dow dipped 0.5%. Wall Street also fretted over the rising 10-year Treasury yield, which ended the day at a 15-year high of 4.26%. Oil and gold prices fell again, but the dollar rose.

On Thursday, investors watched stock prices tumble for the third day in a row. The tech-heavy Nasdaq and small-cap stocks that make up the Russell 2000 dropped 1.2%, while the S&P 500 and the Dow declined 0.8%, and the Global Dow lost 0.7%. Energy was the only sector that did not post a loss. The government bond market extended its worrisome sell off, pushing up the yield on 10-year Treasuries by 5 basis points to 4.31%, the highest level since 2007. Crude oil prices advanced to $80.06 per barrel after a three-day drop, gold prices fell, and the dollar was unchanged.

Last Friday, stocks capped off a volatile week with mixed returns. Energy and defensive sectors such as utilities and consumer staples outperformed, while communication services saw the steepest declines. The Russell 2000 posted a modest gain of 0.5%, and the Dow edged up less than 0.1%. The Global Dow and the Nasdaq dipped 0.3% and 0.2%, respectively. The S&P 500 ended the day flat. The 10-year Treasury yield fell to 4.25%. Crude oil prices increased to $81.40 per barrel. Gold prices inched up, but the dollar pulled back slightly.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Retail sales surged 0.7% in July from the previous month — the fastest pace since January — and have increased 3.2% since July 2022. Retail trade sales advanced 0.6% from June and 2.0% from July 2022. Nonstore (online) retail sales increased 1.9% from June and 10.3% from July 2022, while sales at food services and drinking places were up 1.4% from June and 11.9% higher than last year. Other retailers that outperformed last month include sporting goods, hobby, musical instrument, and book stores (1.5%); clothing & clothing accessories stores (1.0%); and department stores (0.9%). Retailers that showed weakness in July (and tend to be sensitive to high interest rates) include furniture & home furnishing stores (-1.8%); electronics and appliance stores (-1.3%); and auto dealers (-0.4%).

- Prices for U.S. imports rose 0.4% in July after falling 0.1% the previous month. Despite the July increase, which was driven by higher fuel prices, U.S. import prices declined 4.4% over the past 12 months, after increasing 8.8% from July 2021 to July 2022. Export prices increased 0.7% in July, following a 0.7% decline in June. Even though July saw the largest monthly advance since June 2022, U.S. export prices have fallen 7.9% over the last 12 months.

- The number of residential building permits issued in July increased 0.1% from the June total and is 13.0% below the July 2022 figure. Issued building permits for single-family housing increased 0.6% in July to an annual rate of 930,000 units, the highest level in more than a year. Permits for housing projects with five units or more fell 0.2% last month and were 32.2% below the level in July 2022. Housing starts increased 3.9% last month and were 5.9% above the total from a year earlier. Single-family housing starts in July were 6.7% above the prior month’s rate. Home completions dropped 11.8% in July from June and were 5.4% below the July 2022 total. Single-family home completions in July were 1.3% higher than June’s figure.

- Industrial production rose 1.0% in July after falling in the two previous months. Manufacturing output and mining both climbed 0.5% in July after falling 0.5% and 0.9%, respectively, in June. Utilities shot up 5.4%, as hot weather spurred demand for cooling. Overall, total industrial production in July was 0.2% below last year’s level. Most major market groups recorded growth in July. Production of consumer goods led the pack with an increase of 1.4%, boosted by a 4.8% jump in the output of automotive products.

- The national average retail price for regular gasoline was $3.850 per gallon on August 14, $0.022 per gallon higher than the prior week’s price but $0.088 less than a year ago. Also, as of August 14, the East Coast price decreased $0.026 to $3.711 per gallon; the Midwest price climbed $0.090 to $3.768 per gallon; the Gulf Coast price fell $0.038 to $3.415 per gallon; the Rocky Mountain price ticked up $0.010 to $3.954 per gallon; and the West Coast price advanced $0.074 to $4.759 per gallon.

- For the week ended August 12, there were 239,000 new claims for unemployment insurance, a decrease of 11,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended August 5 was 1.2%, an increase of 0.1% from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 5 was 1,716,000, an increase of 32,000 from the previous week’s unrevised level. States and territories with the highest insured unemployment rates for the week ended July 29 were Puerto Rico (2.6%), New Jersey (2.5%), California (2.2%), Rhode Island (2.0%), Massachusetts (2.0%), Connecticut (1.9%), New York (1.9%), Oregon (1.9%), Pennsylvania (1.8%), and Minnesota (1.7%). The largest increases in initial claims for unemployment insurance for the week ended August 5 were in Ohio (+5,416), California (+2,363), Texas (+2,237), New Jersey (+1,622), and Connecticut (+1,288), while the largest decreases were in Missouri (-2,644), Florida (-410), Iowa (-335), Arkansas (-198), and Kentucky (-79).

Eye on the Week Ahead

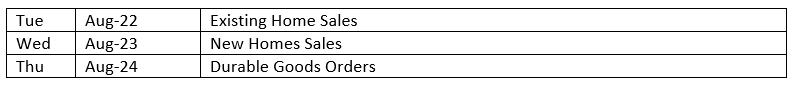

Data on the housing sector for July is available this week. Sales of both new and existing homes declined in June due to rising mortgage rates and dwindling inventory. However, home prices have remained strong. Investors will also be looking for insight from the Federal Reserve’s Economic Symposium in Jackson Hole, where central bankers from around the world will meet to discuss the health of the global economy.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.