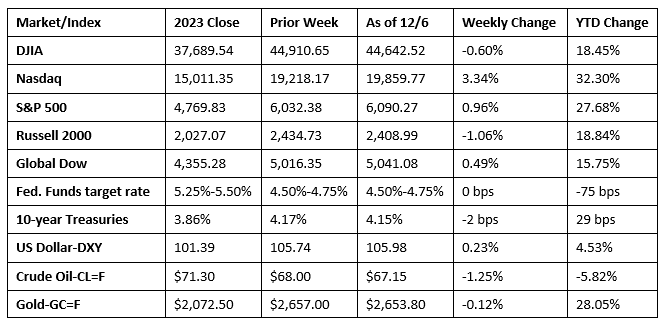

A stronger-than-expected jobs report (see below) helped drive stocks mostly higher last week and raise optimism of an interest rate cut when the Federal Reserve meets later in December. Consumer discretionary, communication services, and information technology helped drive the market, which was otherwise tempered by downturns in energy, utilities, real estate, and materials. Long-term bond prices were relatively stable, with yields on 10-year Treasuries slipping 2.0 basis points from the prior week’s closing mark. Crude oil prices declined on demand fears despite OPEC+’s decision to extend production cuts until the end of 2026. The dollar inched higher, while gold prices dipped lower.

A surge in tech shares and large-cap stocks drove the NASDAQ (1.0%) and the S&P 500 (0.24%) to record highs last Monday. Along with information technology, other sectors outperforming were communication services and consumer discretionary. The Global Dow gained 0.1%, while the Dow (-0.3%) declined. The small caps of the Russell 2000 ended the day essentially unchanged. Yields on 10-year Treasuries inched up to 4.19%. Crude oil prices settled at $68.09 per barrel. The dollar climbed 0.6%, partially rebounding from a 1.7% decline the previous week. Gold prices fell 0.7% to $2,661.60 per ounce.

Last Tuesday saw both the NASDAQ (0.4%) and the S&P 500 (0.1%) notch new record highs, while the Russell 2000 (-0.8%) and the Dow (-0.2%) declined. The Global Dow inched up 0.3%. Ten-year Treasury yields ticked up to 4.22%. Crude oil prices closed the session at about $69.99 per barrel, an increase of 2.8% from the previous day’s estimate. The dollar dipped 0.1%, while gold prices increased 0.3%.

All three major market indexes reached new record highs last Wednesday. The NASDAQ (1.3%), the Dow (0.7%), and the S&P 500 (0.6%) each posted notable gains, with the Dow closing above 45,000 for the first time in its history. Tech stocks continued to thrive, while some encouraging earnings reports from major companies bolstered investor confidence. The small caps of the Russell 2000 gained 0.4%, while the Global Dow dipped 0.1%. Crude oil prices gave back some of the prior day’s gains, falling 1.7% to $68.72 per barrel. Ten-year Treasury yields slipped to 4.18%. The dollar was unchanged, while gold prices rose 0.2%.

The markets trended lower last Thursday ahead of Friday’s employment data, which could be the determining factor in whether the Federal Reserve lowers interest rates later this month. Of the benchmark indexes listed here, only the Global Dow (0.3%) ended higher. The Russell 2000 fell 1.3%, while the Dow lost 0.6%. Both the S&P 500 and the NASDAQ dipped 0.2%. Ten-year Treasury yields were flat, crude oil prices slipped to $68.41 per barrel, the dollar fell 0.6%, and gold prices declined 0.8%.

Stocks closed last week with mixed results. The Dow (-0.3%) and the Global Dow (-0.1%) declined, while the NASDAQ (0.8%), the Russell 2000 (0.5%), and the S&P 500 (0.3%) advanced. Last Friday’s gains sent both the NASDAQ and the S&P 500 to new record highs. Yields on 10-year Treasuries dipped to 4.15%. Crude oil prices dropped 1.7%. The dollar and gold prices each increased by 0.3%.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- As anticipated, the labor sector recovered from severe weather and strike activity in the previous month. Employment rose by 227,000 in November following upward revisions to both September (+32,000) and October (+24,000). Employment increased by an average of 186,000 per month over the 12 months prior to November. The unemployment rate, at 4.2%, rose by 0.1 percentage point, while the number of unemployed increased by 161,000 to 7.1 million. These measures are higher than a year earlier, when the jobless rate was 3.7%, and the number of unemployed people was 6.3 million. The labor force participation rate was 62.5%, 0.1 percentage point lower than the October estimate. The employment-population ratio declined 0.2 percentage point to 59.8%. The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.7 million in November but was up from 1.2 million a year earlier. In November, the long-term unemployed accounted for 23.2% of all unemployed people. In November, average hourly earnings rose by $0.13, or 0.4%, to $35.61. Over the past 12 months, average hourly earnings have increased by 4.0%. The average workweek edged up by 0.1 hour to 34.3 hours in November.

- The manufacturing sector picked up steam in November, according to the latest survey from S&P Global. Purchasing managers noted that the reduction in new orders was at the slowest pace in the last five months. Some manufacturers indicated that domestic demand conditions had started to improve, however new export orders decreased at a sharper pace as international demand worsened. Although the pace of reduction in total new orders eased, a further decline in new business contributed to another drop in manufacturing production for the fourth straight month. The S&P Global US Manufacturing Purchasing Managers’ Index™ remained below the 50.0 break-even mark in November, but at 49.7, pointed to only a marginal worsening in the health of the manufacturing sector.

- Business activity increased in the services sector in November at the fastest pace since March 2022. The expansion in services was largely driven by the largest rise in new business in just over two-and-a-half years. The S&P Global US Services PMI® Business Activity Index rose to 56.1 in November, up from 55.0 in October and above the 50.0 neutral mark for the 22nd consecutive month.

- The number of job openings, at 7.7 million, increased by 372,000 in October from the prior month, according to the latest Job Openings and Labor Turnover Summary. Despite the increase, job openings were 941,000 under the pace a year earlier. In October, the number of hires fell 269,000 to 5.3 million and was down by 501,000 over the year. Total separations, which includes quits, layoffs and discharges, and other separations, were little changed at 5.3 million but were down 369,000 from October 2023.

- The latest report on the international trade deficit was released December 5 and was for October. The goods and services deficit was $73.8 billion, down $10.0 billion, or 11.9%, from September. October exports were $265.7 billion, $4.3 billion, or 1.6%, less than September exports. October imports were $339.6 billion, $14.3 billion, or 4.0%, less than September imports. Year to date, the goods and services deficit increased $80.7 billion, or 12.3%, from the same period in 2023. Exports increased $94.0 billion, or 3.7%. Imports increased $174.7 billion, or 5.4%.

- The national average retail price for regular gasoline was $3.034 per gallon on December 2, $0.010 per gallon below the prior week’s price and $0.197 per gallon less than a year ago. Also, as of December 2, the East Coast price ticked down $0.022 to $2.989 per gallon; the Midwest price increased $0.036 to $2.902 per gallon; the Gulf Coast price fell $0.054 to $2.581 per gallon; the Rocky Mountain price declined $0.041 to $2.787 per gallon; and the West Coast price decreased $0.021 to $3.863 per gallon.

- For the week ended November 30, there were 224,000 new claims for unemployment insurance, an increase of 9,000 from the previous week’s level, which was revised up by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended November 23 was 1.2%, a decrease of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended November 23 was 1,871,000, a decrease of 25,000 from the previous week’s level, which was revised down by 11,000. States and territories with the highest insured unemployment rates for the week ended November 16 were New Jersey (2.3%), California (2.0%), Washington (2.0%), Alaska (1.9%), Puerto Rico (1.9%), Nevada (1.7%), Rhode Island (1.7%), Massachusetts (1.6%), Minnesota (1.6%), and New York (1.6%). The largest increases in initial claims for unemployment insurance for the week ended November 23 were in California (+4,573), Illinois (+2,814), Pennsylvania (+2,785), Georgia (+2,152), and Michigan (+1,976), while the largest decreases were in New Jersey (-853), Delaware (-94), Hawaii (-57), Virginia (-21), and West Virginia (-4).

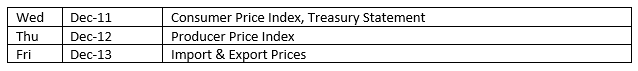

Eye on the Week Ahead

November inflation data is available this week with the releases of both the Consumer Price Index (CPI) and the Producer Price Index (PPI). October saw the CPI rise 0.2% for the month and 2.6% for the year, while the PPI ticked up 0.2% for October and 2.2% for the year.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.