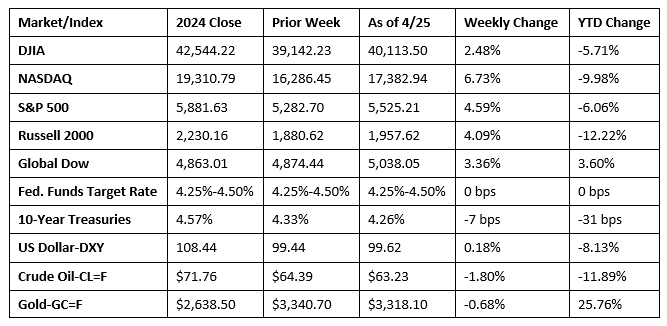

Wall Street enjoyed a solid week of gains as investors were encouraged by signs of progress in the U.S.-China trade dispute. Each of the benchmark indexes listed here moved higher, driven by gains in AI megacaps and some blue-chip stocks. First-quarter earnings season is in full swing. Of the 180 S&P 500 companies reporting so far, 73% beat expectations. Ten of the 11 market sectors posted weekly advances, with the exception of consumer staple companies, which dipped about 0.73%. Last week didn’t begin on a favorable note, as stocks closed sharply lower on Monday after President Trump continued his criticism of Federal Reserve Chair Jerome Powell. The dollar index fell to 98.2 on Monday, the lowest rate since February 2022. However, as trade tensions eased, stocks posted gains over the next four days. Long-term bond yields fell for the second straight week. Persistent oversupply concerns and uncertainty over the U.S.- China trade talks pulled crude oil prices lower.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- New orders for durable goods rose for the third straight month in March after increasing 9.2%. Excluding transportation, new orders were virtually unchanged. Excluding defense, new orders increased 10.4%. Transportation equipment, also up three consecutive months, led the overall increase in new orders after climbing 27.0%.

- Sales of new single-family houses in March were 7.4% above the February rate and 6.0% above the March 2024 pace. The estimate of new houses for sale at the end of March was 0.6% above the February estimate and 7.9% above the March 2024 rate. This represents an inventory of 8.3 months at the current sales pace. The March inventory estimate was 6.7% below the February figure but 1.2% above the March 2024 estimate. The median sales price of new houses sold in March was $403,600. This was 1.9% below the February price of $411,500 and 7.5% below the March 2024 price of $436,400. The average sales price of new houses sold in March 2025 was $497,700. This was 1.0% above the February 2025 price of $492,700 but 4.7% below the March 2024 price of $522,500.

- Existing-home sales fell 5.9% in March and 2.4% from a year ago. Inventory of unsold homes represented a supply of 4.0 months at the current sales pace. The median existing-home price in March was $403,700, up 2.7% from a year ago. Sales of existing single-family homes also tumbled in March, dropping 6.4%. The median existing single-family home price was $408,000 in March, up 2.9% from March 2024.

- The national average retail price for regular gasoline was $3.141 per gallon on April 21, $0.027 per gallon below the prior week’s price and $0.527 per gallon less than a year ago. Also, as of April 21, the East Coast price ticked down $0.033 to $2.983 per gallon; the Midwest price increased $0.004 to $3.012 per gallon; the Gulf Coast price fell $0.063 to $2.684 per gallon; the Rocky Mountain price increased $0.032 to $3.130 per gallon; and the West Coast price declined $0.047 to $4.220 per gallon.

- For the week ended April 19, there were 222,000 new claims for unemployment insurance, an increase of 6,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended April 12 was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended April 12 was 1,841,000, a decrease of 37,000 from the previous week’s level, which was revised down by 7,000. States and territories with the highest insured unemployment rates for the week ended April 5 were New Jersey (2.5%), California (2.3%), Rhode Island (2.3%), Minnesota (2.2%), Washington (2.2%), Illinois (2.0%), Massachusetts (2.0%), the District of Columbia (1.9%), New York (1.8%), Oregon (1.7%), and Puerto Rico (1.7%). The largest increases in initial claims for unemployment insurance for the week ended April 12 were in Kentucky (+4,292), Missouri (+1,974), Pennsylvania (+1,858), Michigan (+1,012), and Connecticut (+955), while the largest decreases were in California (-3,296), Tennessee (-2,622), Oregon (-1,869), Illinois (-1,320), and Wisconsin (-1,313).

Eye on the Week Ahead

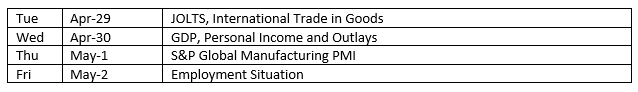

The last week of April brings with it the release of several potentially market-moving reports. The initial report on gross domestic product for the first quarter of 2025 is released. The economy expanded at an

annualized rate of 2.4% in the fourth quarter of 2024. The March report on personal income and expenditures is out midweek. February saw personal income grow 0.8% and consumer spending rose 0.4%, while prices for goods and services climbed 0.3%. Finally, the April jobs report is available at the end of the week. Employment rose by 228,000 in March, while the unemployment rate ticked up to 4.2%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.