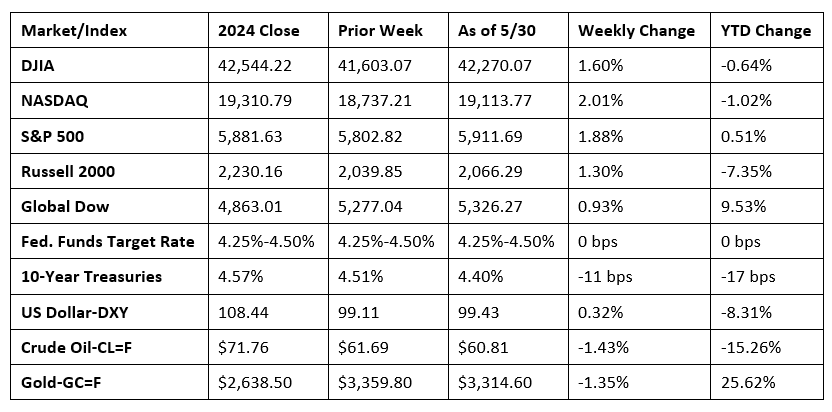

Despite a dip at the end of the week, stocks closed last week higher as investors digested renewed trade tensions with China, while inflation showed signs of cooling. Each of the benchmark indexes ended the week higher, riding solid gains in tech shares. All of the market sectors closed the week with gains, with notable advances in information technology, consumer discretionary, real estate, and financials. Long-term bond yields declined. Crude oil prices fell for the second week in a row. The dollar continued to slip lower, while gold prices fell as traders moved from safety to risk.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- Gross domestic product (GDP) decreased at an annual rate of 0.2% in the first quarter of 2025, according to the second estimate released by the U.S. Bureau of Economic Analysis. In the fourth quarter of 2024, GDP increased 2.4%. Compared to the fourth quarter, the downturn in GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, a deceleration in consumer spending, and a downturn in government spending that were partly offset by increases in investment and exports. Personal consumption expenditures (PCE), a major component in the calculation of GDP, rose 1.2% in the first quarter, compared to an increase of 4.0% in the fourth quarter. In the first quarter, consumer spending on goods ticked up 0.1% (6.2% in the fourth quarter), while spending on services rose 1.7% (3.0% in the fourth quarter).

- According to the latest report from the Bureau of Economic Analysis, both personal income and disposable (after-tax) personal income increased 0.8% in April. Personal consumption expenditures, a measure of consumer spending, increased 0.2%. From the preceding month, the PCE price index for April increased 0.1%. Excluding food and energy, the PCE price index also increased 0.1%. From April 2024, the PCE price index increased 2.1%, while the PCE price index excluding food and energy increased 2.5%.

- New orders for durable goods, which had increased for four straight months, fell 6.3% in April. Transportation equipment, which declined 17.1%, drove the overall decrease in durable goods orders. Within transportation equipment, commercial aircraft bookings fell 51.5%. Business equipment orders fell 1.3% in April, the largest drop since October 2024. Durable goods orders rose 4.2% since April 2024.

- The international trade in goods deficit was $87.6 billion in April, down $74.6 billion, or 46.0%, from the March estimate. Exports of goods for April were $6.3 billion, or 3.4%, more than March exports. Imports of goods for April were $68.4 billion, or 19.8%, less than March imports.

- The national average retail price for regular gasoline was $3.160 per gallon on May 26, $0.013 per gallon below the prior week’s price and $0.417 per gallon less than a year ago. Also, as of May 26, the East Coast price increased $0.005 to $2.995 per gallon; the Midwest price fell $0.009 to $3.018 per gallon; the Gulf Coast price decreased $0.060 to $2.726 per gallon; the Rocky Mountain price dipped $0.013 to $3.118 per gallon; and the West Coast price declined $0.029 to $4.258 per gallon.

- For the week ended May 24, there were 240,000 new claims for unemployment insurance, an increase of 14,000 from the previous week’s level, which was revised down by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended May 17 was 1.3%, an increase of 0.1 percentage point from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended May 17 was 1,919,000, an increase of 26,000 from the previous week’s level, which was revised down by 10,000. This is the highest level for insured unemployment since November 13, 2021, when it was 1,970,000. States and territories with the highest insured unemployment rates for the week ended May 10 were New Jersey (2.2%), California (2.1%), Washington (2.1%), Rhode Island (1.9%), District of Columbia (1.8%), Massachusetts (1.8%), Illinois (1.6%), Nevada (1.6%), New York (1.6%), Oregon (1.6%), and Puerto Rico (1.6%). The largest increases in initial claims for unemployment insurance for the week ended May 17 were in Illinois (+1,162), Missouri (+447), Louisiana (+383), Connecticut (+246), and New York (+234), while the largest decreases were in Virginia (-1,277), Michigan (-1,192), California (-686), Florida (-547), and Massachusetts (-399).

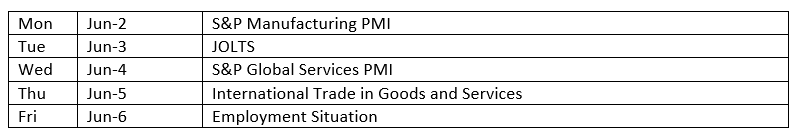

Eye on the Week Ahead

The jobs report for May is out this week. April saw employment increase by 177,000, while average hourly earnings rose 0.2% for the month.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.