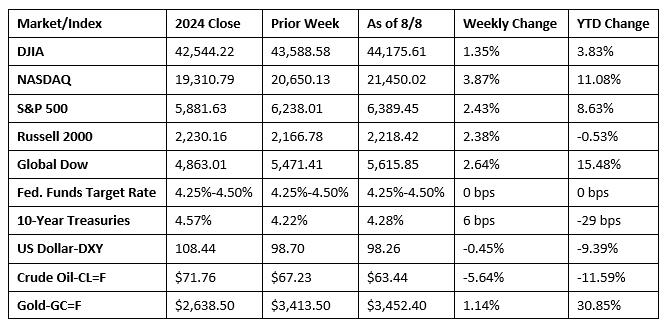

Wall Street rebounded from the previous week’s sell-off. Stocks jumped higher last Monday, aided by major dip-buying. However, investors pulled away from risk midweek, particularly following President Trump’s sweeping tariffs, which took effect last Thursday. Nevertheless, stocks experienced a major uptick last Friday to end the week higher. The S&P 500 and the NASDAQ hit record highs, while the Dow and the Russell 2000 also made solid gains. Speculation increased that the Federal Reserve would cut interest rates in September following the latest weak jobs report and the imposition of last week’s new tariffs. Information technology, consumer discretionary, and consumer staples led the market sectors. Bond values trended higher, pulling yields lower. Crude oil prices fell to a nearly two-month low amid concerns over growing tariffs.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The latest report on the goods and services trade deficit was released on August 5 and showed that the goods and services deficit was $60.2 billion in June, down $11.5 billion, or 16.0%, from the revised May estimate. June exports were $277.3 billion, $1.3 billion, or 0.5%, less than May exports. June imports were $337.5 billion, $12.8 billion, or 3.7%, less than May imports. Since June 2024, the goods and services deficit increased $161.5 billion, or 38.3%. Exports increased $82.2 billion, or 5.2%. Imports increased $243.7 billion, or 12.1%.

- Business activity in the services sector increased at its sharpest pace so far this year amid solid and accelerated expansion in new business. Companies responded to higher workloads by hiring additional staff, albeit only modestly. Meanwhile, tariffs continued to add to inflationary pressures, resulting in faster increases in both input costs and output prices. The S&P Global US Services PMI® Business Activity Index rose to a seven-month high of 55.7 in July, up from 52.9 in June.

- The national average retail price for regular gasoline was $3.140 per gallon on August 4, $0.017 per gallon above the prior week’s price but $0.308 per gallon less than a year ago. Also, as of August 4, the East Coast price increased $0.017 to $3.016 per gallon; the Midwest price rose $0.029 to $3.043 per gallon; the Gulf Coast price ticked down $0.017 to $2.731 per gallon; the Rocky Mountain price increased $0.006 to $3.127 per gallon; and the West Coast price rose $0.028 to $4.023 per gallon.

- For the week ended August 2, there were 226,000 new claims for unemployment insurance, an increase of 7,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended July 26 was 1.3%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended July 26 was 1,974,000, an increase of 38,000 from the previous week’s level, which was revised down by 10,000. This was the highest level for insured unemployment since November 6, 2021, when it was 2,041,000. States and territories with the highest insured unemployment rates for the week ended July 19 were New Jersey (2.8%), Puerto Rico (2.7%), Rhode Island (2.6%), California (2.2%), Minnesota (2.2%), the District of Columbia (2.1%), Massachusetts (2.1%), Washington (2.1%), Oregon (1.9%), and Pennsylvania (1.9%). The largest increases in initial claims for unemployment insurance for the week ended July 26 were in Kansas (+254), Vermont (+252), Louisiana (+87), Maryland (+75), and Mississippi (+58), while the largest decreases were in Kentucky (-6,212), Texas (-2,720), Georgia (-1,949), New York (-1,464), and California (-1,174).

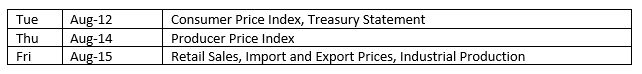

Eye on the Week Ahead

Inflation data is on the docket this week with the releases of the July Consumer Price Index and the Producer Price Index. June saw the CPI increase 0.3%, while the PPI was flat.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.