Beginning in 2025, seniors can take advantage of a new $6,000 tax deduction that may help them cover the rising costs of housing, health care, and daily living by potentially allowing more of their income to remain untaxed. The deduction, part of the One Big Beautiful Bill Act (OBBBA) enacted in July 2025, will be available through 2028.

Eligibility rules

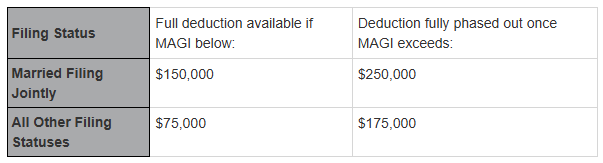

Taxpayers who are age 65 or older by the end of the tax year and have a modified adjusted gross income (MAGI) of less than $75,000 may claim the $6,000 above-the-line deduction; the deduction gradually phases out for single filers with a MAGI between $75,000 and $175,000 and is completely eliminated for single filers with a MAGI of $175,000 or more. Married taxpayers age 65 or older with a combined MAGI of less than $150,000 and filing a joint tax return can both claim the deduction for a total of $12,000. The deduction for joint filers begins to phase out at $150,000 and is completely eliminated when their MAGI is $250,000 or more.

Claiming the deduction

For qualified taxpayers, this new deduction can be stacked on top of the standard deduction. For 2025, the standard deduction amount is $15,750 for a single individual and $31,500 for married couples filing jointly. Additionally, individuals age 65 and older get an additional “bump” in their standard deduction in the form of an extra $2,000 deduction ($1,600 per qualifying individual if married filing jointly). Add this all together and this means that, for 2025, an eligible individual can deduct a total of up to $23,750 ($6,000 + $15,750 + $2,000) while qualified married couples may deduct up to $46,700 ($12,000 + $31,500 + $3,200). Because it is an above-the-line deduction, it is available to taxpayers who itemize and to those who do not itemize deductions on their returns. The deduction phases out at a rate of 6% of income exceeding the income thresholds.

Social Security impact

Although this deduction reduces taxable income, it does not directly change the manner in which Social Security benefits are taxed. Benefits remain taxable if the taxpayer’s adjusted gross income, tax-exempt interest income, and half of the taxpayer’s Social Security income exceed $25,000 (single) or $32,000 (married filing jointly). However, the higher deduction may reduce combined income enough to keep a taxpayer below these thresholds, depending on income sources and amounts.

Moving forward

The new $6,000 senior deduction may offer an increased tax benefit for eligible individuals. But with income phaseouts and the deduction expiring after 2028, unless renewed by Congress, some planning may be necessary to take full advantage of the deduction.

Prepared by Broadridge Advisor Solutions. © 2025 Broadridge Financial Services, Inc.