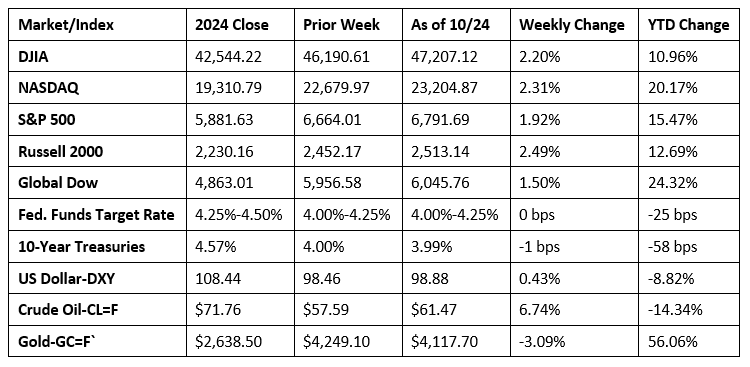

The major stock market indexes continued to climb last week, with the S&P 500 and the NASDAQ reaching new record highs. Investors were buoyed by a strong start to the third-quarter earnings season, particularly for major banks, with most companies reporting better-than-expected earnings and profits. On the global front, the announcement of a meeting between the United States and China muted concerns surrounding trade tariffs. While consumer prices rose in September, the advance was softer than expected, bolstering hopes for an interest rate cut by the Federal Reserve following its meeting this week. Among the market sectors, information technology and communication services were the leading performers. Ten-year Treasury yields were generally lower last week, dipping below 4.0%. Gold prices, which had been on a notable rally, declined last week, largely due to profit-taking and a reduction in safe-haven demand. Crude oil prices were volatile throughout the week, falling to their lowest levels in months, only to surge later in the week after the U.S. sanctioned two major Russian oil firms.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The release of most economic data has been delayed due to the government shutdown.

- The Consumer Price Index (CPI) increased 0.3% in September following a 0.4% rise in August. Note: The September CPI data collection was completed before the government shutdown. In September, prices for gasoline rose 4.1% and were the largest factors in the overall monthly increase. Prices for energy rose 1.5% over the month. Food prices increased 0.2% last month. Consumer prices less food and energy rose 0.2% in September after rising 0.3% in each of the two preceding months. The CPI rose 3.0% for the 12 months ended in September after rising 2.9% over the 12 months ended in August. Prices less food and energy also rose 3.0% over the last 12 months. Energy prices increased 2.8% for the year. Prices for food increased 3.1% since September 2024.

- Existing-home sales rose 1.5% in September 2025. According to National Association of Realtors® Chief Economist Lawrence Yun, “As anticipated, falling mortgage rates are lifting home sales. Improving housing affordability is also contributing to the increase in sales.” Since September 2024, sales of existing homes have risen 4.1%. At a 4.6-month supply in September, unsold inventory was up 1.3% from the prior month and 14.0% from a year ago. The median existing-home price was $415,200 in September, down 1.7% from the August price of $422,400 but up 2.1% from one year ago ($406,700). Sales of existing single-family homes rose 1.7% in September from August and 4.5% from September 2024. The median existing single-family home price in September was $420,700, down from the August price of $427,700 but higher than the September 2024 price of $411,400.

- The national average retail price for regular gasoline was $3.019 per gallon on October 20, $0.042 per gallon below the prior week’s price and $0.125 per gallon less than a year ago. Also, as of October 20, the East Coast price decreased $0.050 to $2.902 per gallon; the Midwest price fell $0.007 to $2.805 per gallon; the Gulf Coast price declined $0.067 to $2.556 per gallon; the Rocky Mountain price dropped $0.052 to $2.997 per gallon; and the West Coast price dipped $0.047 to $4.166 per gallon.

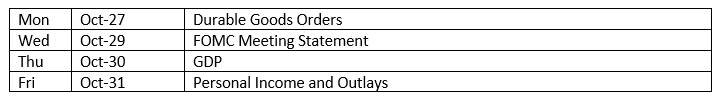

Eye on the Week Ahead

There will be little relevant economic data available during the government shutdown, with the exception of this week’s Federal Open Market meeting.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2025 Broadridge Financial Solutions, Inc. All Rights Reserved.