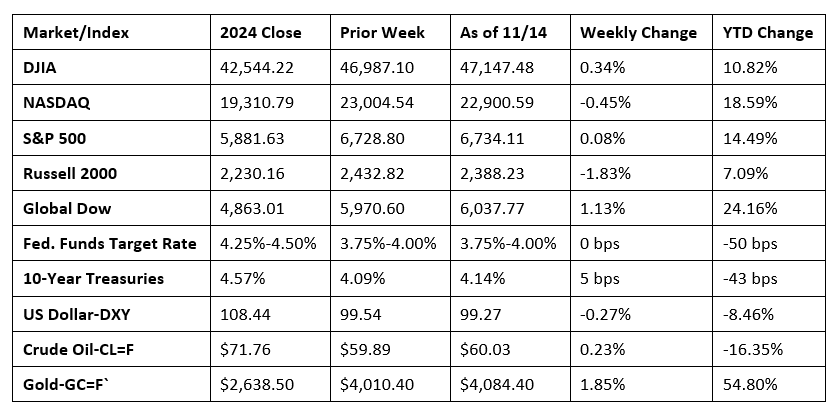

Last week was marked by the re-opening of the U.S. government after a prolonged shutdown. However, despite a significant boost to the stock market at the beginning of the week, the positive momentum waned as the week progressed as investors were concerned about high valuation of AI stocks and uncertainty over Federal Reserve policy. The NASDAQ and the Russell 2000 ended the week in the red, while the S&P 500, the Dow, and the Global Dow closed higher. The AI sector, which has been a major market mover for much of the year, experienced significant volatility as investors worried about long-term sustainability. Health care, energy, and materials were market sector gainers, while consumer discretionary and communication services underperformed. Ten-year Treasury yields rose, likely reflecting reduced expectations for another interest rate cut at the next Federal Reserve meeting in December. Crude oil prices moved very little from the prior week as ongoing concerns surrounding increasing U.S. inventories and overproduction weighed on prices.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The release of most economic data continued to be delayed due to the government shutdown. However, as information becomes available, it will be included herein.

- The national average retail price for regular gasoline was $3.056 per gallon on November 10, $0.037 per gallon above the prior week’s price and $0.004 per gallon higher than a year ago. Also, as of November 10, the East Coast price decreased $0.005 to $2.912 per gallon; the Midwest price rose $0.082 to $2.910 per gallon; the Gulf Coast price increased $0.088 to $2.599 per gallon; the Rocky Mountain price dropped $0.029 to $2.909 per gallon; and the West Coast price rose $0.031 to $4.159 per gallon.

Eye on the Week Ahead

The end of the government shutdown should result in the release of economic data and reports. We will continue to track the release of important economic reports as they become available.

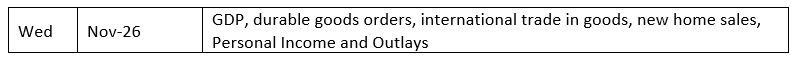

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2025 Broadridge Financial Solutions, Inc. All Rights Reserved.