The stock market was largely driven by mixed labor data and optimism over a possible interest rate cut following the Federal Reserve’s meeting next week. Each of the benchmark indexes listed here ended last week higher, with AI stocks playing a significant role. The NASDAQ and small caps of the Russell 2000 led the way, while the S&P 500 approached a new record high. Information technology, energy, and consumer discretionary outperformed among the market sectors, while health care and utilities lagged. Bonds experienced a challenging week, with Treasury yields climbing over 10 basis points, as a selloff in bonds resulted in a drop in price. The latest inflation data (see below) showed consumer prices were up 0.8 percentage point over the Fed’s 2.0% target. Crude oil prices ticked up as concerns about global oversupply were offset somewhat by ongoing geopolitical tensions and the expectation for a rate cut by the Federal Reserve.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- According to the latest report from the Bureau of Economic Analysis, the Personal Consumption Expenditures Price Index, the preferred measure of inflation of the Federal Reserve, rose 0.3% in September and 2.8% over the last 12 months. Core prices, excluding food and energy, rose 0.2% in September and 2.8% since September 2024. The Personal Consumption Expenditures Index, a measure of consumer spending, increased 0.3% in September and 2.1% for the year. Personal income rose 0.4% in September, while disposable (after-tax) personal income increased 0.3%.

- According to the latest survey of purchasing managers by S&P Global, manufacturing accelerated in November but at a slightly slower pace than in the previous month. Nevertheless, November’s increase in operating activity marked the fourth straight month of growth in the manufacturing sector. Survey respondents noted a solid rise in production and a further increase in employment in November, as confidence in the outlook strengthened.

- The services sector continued to expand at a solid pace in November, despite growth softening to a five-month low, according to the latest PMI® survey from S&P Global. Activity was supported by the largest rise in new work so far this year. Confidence in the outlook strengthened following the end of the government shutdown, leading to expectations of improved economic growth in the year ahead.

- Both import and export prices were unchanged in September, according to the latest release from the Bureau of Labor Statistics. Import prices rose 0.3% from September 2024, which was the first 12-month increase since the year ended March 2025. In September, fuel prices declined 1.5%, while nonfuel import prices rose 0.2%. U.S. export prices increased 3.8% over the 12-month period ended in September, the largest over-the-year advance since the year ended December 2022. In September, agricultural exports increased 0.3%, while nonagricultural export prices were unchanged.

- Industrial production (IP) increased 0.1% in September after moving down 0.3% in August. For the third quarter as a whole, IP increased at an annual rate of 1.1%. In September, manufacturing and mining were unchanged from the prior month, while utilities rose 1.1%. Overall, total IP in September was 1.6% above its year-earlier level.

- For the week ended November 29, there were 191,000 new claims for unemployment insurance, a decrease of 27,000 from the previous week’s level, which was revised up by 2,000. This is the lowest level for initial claims since September 24, 2022, when it was 189,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended November 22 was 1.3%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended November 22 was 1,939,000, a decrease of 4,000 from the previous week’s level, which was revised down by 17,000. States and territories with the highest insured unemployment rates for the week ended November 15 were New Jersey (2.3%), Washington (2.3%), California (2.0%), Massachusetts (2.0%), Puerto Rico (1.9%), the District of Columbia (1.8%), Nevada (1.8%), Rhode Island (1.8%), Alaska (1.7%), Connecticut (1.7%), and Oregon (1.7%). The largest increases in initial claims for unemployment insurance for the week ended November 22 were in California (+7,897), Illinois (+2,845), Pennsylvania (+2,472), Washington (+2,283), and New York (+2,235), while the largest decreases were in Kentucky (-1,107), New Jersey (-385), Kansas (-226), the District of Columbia (-77), and Louisiana (-53).

- The national average retail price for regular gasoline was $2.985 per gallon on December 1, $0.076 per gallon below the prior week’s price and $0.049 per gallon less than a year ago. Also, as of December 1, the East Coast price decreased $0.054 to $2.931 per gallon; the Midwest price fell $0.118 to $2.740 per gallon; the Gulf Coast price dropped $0.092 to $2.551 per gallon; the Rocky Mountain price declined $0.089 to $2.783 per gallon; and the West Coast price fell $0.039 to $4.031 per gallon.

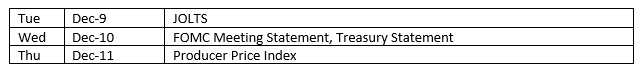

Eye on the Week Ahead

Most of the attention will be focused on the Federal Reserve, which meets this week. It is expected that the Fed will drop the federal funds rate by 25 basis points, which should be good news for Wall Street.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2025 Broadridge Financial Solutions, Inc. All Rights Reserved.