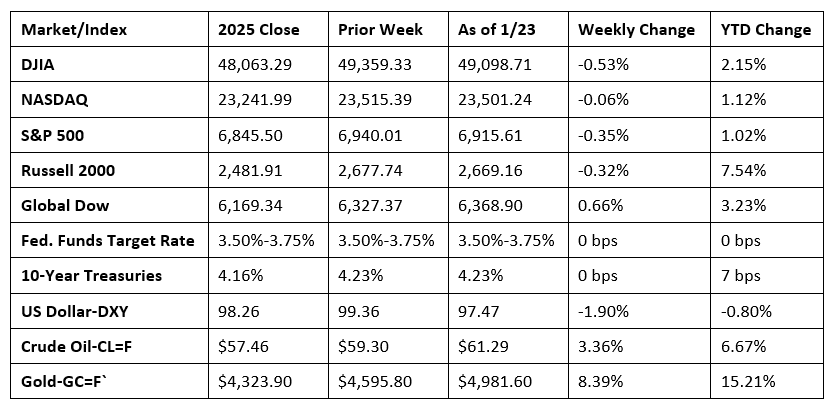

Last week was marked by volatility as investors moved cautiously ahead of this week’s Federal Reserve meeting. Wall Street struggled to find direction amidst tariff concerns and geopolitical tensions, resulting in sharp moves in key sectors, with several major market indexes ultimately ending the week lower. The Dow, the S&P 500, and the NASDAQ declined for the second straight week, impacted by disappointing corporate forecasts and geopolitical uncertainty. Toward the end of the week, a rebound in big tech, coupled with positive economic data, helped offset early-week losses. Among the market sectors, energy, materials, and consumer staples outperformed, while financials, information technology, industrials, and utilities lagged. Crude oil prices extended gains for the fifth consecutive week, supported by geopolitical and supply risks.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The economy expanded at an annualized rate of 4.4% in the third quarter of 2025, according to the latest report on gross domestic product. GDP increased 3.8% in the second quarter. The third-quarter expansion was the largest since the third quarter of 2023. The increase in GDP in the third quarter reflected increases in consumer spending (3.5%), exports (9.6%), government spending (2.2%), and investment, which moved from -13.8% in Q2 to 0.0% in Q3. Imports, which are a subtraction in the calculation of GDP, decreased 4.4%.

- Due to the recent government shutdown, the January 22, 2026, report on Personal Income and Outlays covers October and November, and it replaces releases originally scheduled for November 26 and December 19, 2025. Personal income increased 0.1% in October, followed by a 0.3% advance in November, according to the latest report from the Bureau of Economic Analysis. Disposable (after-tax) personal income ticked up 0.1% in October, followed by an increase of 0.3% in November. Personal consumption expenditures (PCE) rose 0.5% in October, the same increase as in November. From the preceding month, the PCE price index increased 0.2% in both October and November. Excluding food and energy, the PCE price index also increased 0.2% in both months. From the same month one year ago, the PCE price index increased 2.7% in October, followed by an increase of 2.8% in November. Excluding food and energy, the PCE price index also increased 2.7% in October, followed by an advance of 2.8% in November.

- For the week ended January 17, there were 200,000 new claims for unemployment insurance, an increase of 1,000 from the previous week’s level, which was revised up by 1,000. According to the Department of Labor, the advance rate for insured unemployment claims for the week ended January 10 was 1.2%, unchanged from the previous week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended January 10 was 1,849,000, a decrease of 26,000 from the previous week’s level, which was revised down by 9,000. States and territories with the highest insured unemployment rates for the week ended January 3 were Rhode Island (3.3%), New Jersey (3.2%), Washington (2.8%), Massachusetts (2.7%), Minnesota (2.7%), Oregon (2.4%), Connecticut (2.3%), Montana (2.3%), New York (2.3%), California (2.2%), Illinois (2.2%), and Pennsylvania (2.2%). The largest increases in initial claims for unemployment insurance for the week ended January 10 were in Texas (+8,707), California (+5,193), Michigan (+3,804), Tennessee (+3,541), and Ohio (+3,038), while the largest decreases were in New York (-4,572), Oregon (-3,507), Washington (-3,189), Wisconsin (-2,063), and Kentucky (-1,699).

- The national average retail price for regular gasoline was $2.806 per gallon on January 19, $0.027 per gallon above the prior week’s price but $0.303 per gallon less than a year ago. Also, as of January 19, the East Coast price increased $0.022 to $2.763 per gallon; the Midwest price ticked up $0.044 to $2.648 per gallon; the Gulf Coast price rose $0.022 to $2.397 per gallon; the Rocky Mountain price climbed $0.072 to $2.494 per gallon; and the West Coast price inched up $0.008 to $3.657 per gallon.

Eye on the Week Ahead

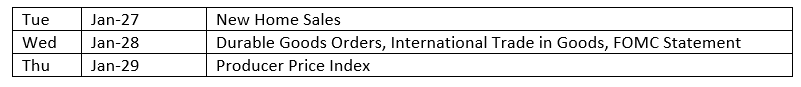

The Federal Open Market Committee meets this week. The odds are slightly in favor of the FOMC maintaining interest rates at their current level, although it would not be a surprise if the Committee decided to lower rates another 25.0 basis points.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates).

© 2026 Broadridge Financial Solutions, Inc. All Rights Reserved.