Stephen Auth, Federated Investors’ Chief Investment Officer, Equities, recently confirmed his positive outlook for stocks. The sources of his optimism are: the economic backdrop is solid; credit and liquidity conditions remain good; Washington and the Fed will address the country’s fiscal and monetary problems in the coming months in a manner sufficient to support corporate earnings through 2018.

At the present time, we tend to agree conditions are good for continued earnings growth in the U.S. As long as this holds, we will remain overweight in large cap U.S. equities and use any long overdue correction as an opportunity to add to positions.

On The One Hand

- The Conference Board’s Consumer Confidence Index rose to 118.9 in June from 117.6 in May.

- First quarter GDP growth was again revised upward to 1.4% from 1.2%. The GDP Price Deflator was revised down to 1.9% from 2.2%.

- Employers continue to be unwilling to lay off people. Initial unemployment claims rose by 2,000 to 244,000. Weekly initial claims have remained below 300,000 every week since the summer of 2007. Continuing claims increased by 6,000 to 1.948 million.

- Personal income increased 0.4% in May. Personal spending was up 0.1%. The PCE Price Index declined 0.1% in May, putting the PCE Price Index up just 1.4% for the year.

- The Chicago Purchasing Managers Index surprised by rising to 65.7 in June from 59.4 in May. The gain was aided by the New Orders Index segment which rose to 71.9 from 61.4.

On The Other Hand

- The May Durable Goods Orders Report registered a decline of 1.1% for the month along with an April revision to -0.9% from the originally reported -0.7%. On a year-over-year basis, new orders for durable goods were up 2.8% and orders excluding transportation were up 4.6%.

- The University of Michigan’s Index of Consumer Sentiment was revised to 95.1 for June, down from the May reading of 97.1.

All Else Being Equal

Both the soft and hard data show consumers remain positive and cautious. Business managers are in the same boat. The job market is tight but data does not indicate employers have begun to bid higher for employees with the skills they need. Inflation remains subdued. Market interest rates began to firm last week with the yield on the bellwether 10 Year Treasury Note rising to 2.30%. The Atlanta Fed again reduced its expectation for Q2 GDP growth last week to 2.70%.

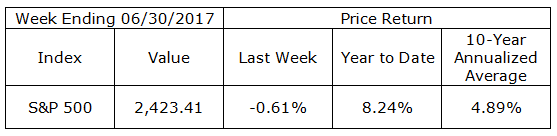

Last Week’s Market

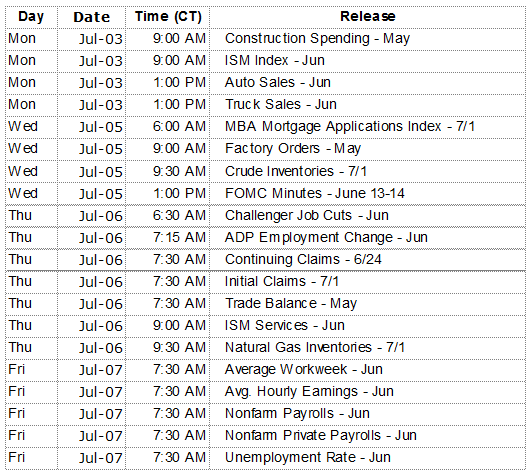

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.