A kid, coming out of the store you are walking into, announces she just bought a candy bar and a stick of gum for $1.10; the candy bar costs $1.00 more than the piece of gum. Question: How much did the gum cost?

We are called on to perform quick calculations and make snap decisions many times a day. There is no need to analyze what our response should be when the brake lights on the car in front of us come on. Our response, slow down and prepare to stop, is nearly automatic and that is a good thing. Fast thinking (intuition) saves us from disaster on a regular basis.

Let’s reconsider the price of gum. Nearly everyone answering the questions quickly thinks the cost of the gum was 10 cents which is incorrect. If the candy bar costs $1.00 more than the gum, and the total spent was $1.10, then the gum had to cost 5 cents. A nickel for the gum and $1.05 for the candy bar gets you to $1.10, the total cost of the transaction for the young shopper.

This is an example demonstrating how quick thinking, intuition, is not always appropriate. Intuitive responses are also frequently influenced by our emotions. Most financial decisions require analytical thinking over intuitive thinking. When you introduce the unpredictable short term fluctuations of our publicly traded markets into your financial calculations, we not only need to make certain we are thinking analytically, we also need to proactively filter out emotional and intuitive influences. Understanding personal finance and investment markets are required knowledge, but understanding ourselves, how we think and make decisions, is no less important. Separating people from their very human emotional and intuitive reactions to market changes is probably the most useful service we offer.

On The One Hand

- Outstanding consumer credit rose $18.4 billion in May, a seasonally adjusted annual rate of 5.75%.

- Producer Price Index increased 0.1% in June. Core PPI was also up 0.1%. On an annual basis, PPI was up 2.0% with core not much different at +1.9%.

- Initial unemployment claims declined 3,000 to 247,000. Continuing claims were lower by 20,000 to 1.945 million.

- The Consumer Price Index (CPI) was unchanged in June. On a year-over-year basis, the government’s CPI rate is 1.6%.

- Industrial production increased 0.4% in June, and the capacity utilization rate rose slightly to 76.6%. Year-over-year, industrial production is up 2.0%

On The Other Hand

- Retail sales declined 0.2% in June, following a 0.1% decline in May.

- Total business inventories increased 0.3% in May. Sales were 0.2% lower for the same month. On an annual basis inventories are up 2.4%.

All Else Being Equal

On the monetary front, Fed president, Janet Yellen, in her testimony before the House of Representatives on Wednesday, made it clear the Fed intends to tighten over time, but is willing to adjust its schedule in response to economic data. On the fiscal front, progress is slow on the two big issues of health care and tax code overhaul. Consumers and business managers will continue to plan and act slowly, pending these outcomes.

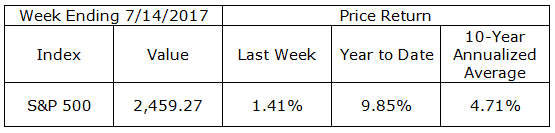

Last Week’s Market

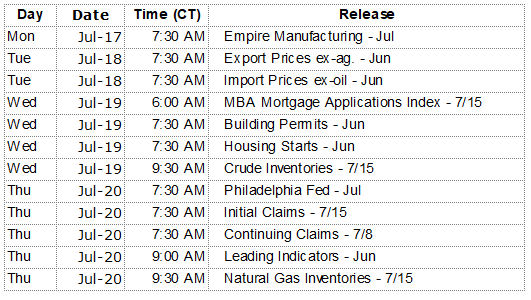

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.