Last week, we wrote about the Fiduciary Rule and the need for improved regulation. In our view, increased transparency would solve much of the confusion. Consumers should have the freedom to choose the type of service which best meets their needs. This freedom, however, requires consumers be fully informed about the issues involved in organizing and executing a successful financial plan. In broad strokes, it begins with organizing the plan with defining objectives followed by determining which steps are under the control of the consumer, analyzing the expected returns and risks of each investment option, identifying the optimal tax strategies, and creating the plans for the management of the investment portfolios not only during the owner’s active life but also in the event of incapacitation or death. Finally, the plan must provide for the efficient transfer to survivors.

In future updates, we will attempt to fill in at least some of the detail buried in each of the broad topics just mentioned. In the end, we hope readers will have enough information to determine whether they are knowledgeable enough and have the time necessary to devote to continuing education, evaluation of recommendations and management of their plans using commission based financial product salespeople or if their success would be better served by dealing with fee based, professional fiduciaries who by law must provide advice and service which is in the clients’ best interest.

Below is the beginning of an outline of steps necessary in the development of a financial plan. We have expanded topic number 1, Establish financial objectives, in this week’s issue. As we continue in future weeks, we will expand each of the topics in the list to provide more detail. Over time we hope to provide enough information to provide a thorough understanding of the issues and procedures necessary to develop and execute a successful financial plan. The first step requires a person to establish his/her objectives. This is a simple step, so simple most slide by it without formally defining their goals. To be successful, this step requires formalization.

- Establish financial objectives and determine the time frame associated with each one. Common objectives are:

- Financing large, near-term purchases of assets like real estate. The time frame may be three to five years but could be longer. Determine the type(s) of financial instrument(s) to be used, if any.

- Provide funds for educational expenses for children and grandchildren. The time frame could be as short as six or seven years for private elementary education or it could be as long as eighteen years or more for higher education needs.

- Retirement objectives vary in scope and time horizon. There are two phases of retirement planning both of which stretch over multiple decades. The accumulation phase will depend on personal goals and generally runs over periods of thirty to fifty years. In retirement, the plan for the distribution phase will also stretch out over a period of thirty to fifty years.

- Legacy planning is the goal of providing resources to individuals and/or charities at the end of life. These plans have the longest time horizons, extending over multiple generations and longer in the case of endowments to charity.

- Determine the amount of savings which will be necessary to fund the investment accounts sufficiently.

- Determine the types of investment accounts available to best take advantage of provisions in the tax code.

- Identify investment classes and determine the realistic expected returns each might generate over the spans of time associated with each objective.

- Identify the risks involved with investing in each of the available asset classes.

- Determine when cash outflows need to begin and the types of accounts those withdrawals should be taken from.

On The One Hand

-

- Retail sales increased 0.3% in April and were revised upward by 0.2% to an increase of 0.8% for the previous month. Retail sales are up a healthy 4.7% from a year ago.

- Inventories were unchanged in March putting the inventories-to-sales ratio at 1.34, down from the year ago level of 1.38.

- Industrial production rose 0.7% in April. Capacity utilization rose to 78% from 77.6% the previous month.

- Initial unemployment claims increased by 11,000 to 222,000. Continuing claims decreased by 87,000 to 1.707 million, the lowest level since December 1, 1973.

- The index of leading economic indicators was up 0.4% in April and were revised upward by 0.1% to an increase of 0.4% in March.

On The Other Hand

Housing starts gave up ground in April, declining 3.7%. Starts are up 10.5% versus a year ago. New building permits declined 1.8% in April.

All Else Being Equal

The Atlanta Fed raised its GDPNow estimate for real Q2 GDP growth by 0.1% to 4.1%. The New York Fed’s Nowcast estimate stands at a more conservative rate of 3.20%. These estimates indicate the U.S. economy is neither slowing nor overheating.

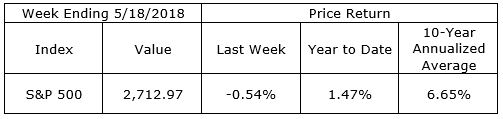

Last Week’s Market

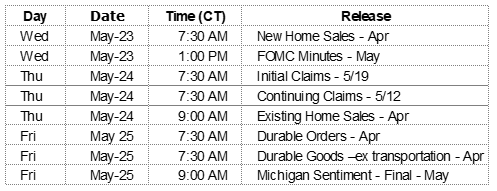

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.