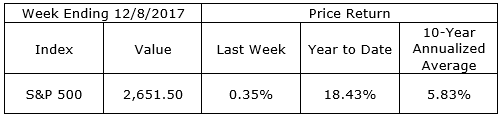

The last 10% or greater correction experienced by the market as measured by the S&P 500 ended on February 11, 2016 with a decline of 13.31%. The index has since risen from that low point of 1,829.08 to Friday’s new high close of 2,651.50. Over that 95 week run the index is up 44.96%. Following this strong performance, it is reasonable to believe things might get more difficult for the market. It is not likely the next 95 weeks will produce another 45% gain.

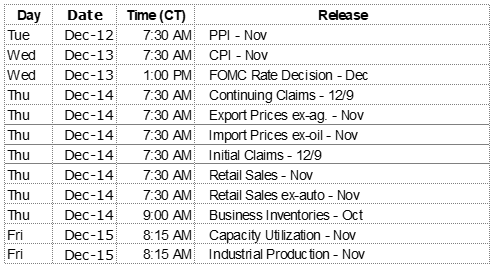

On the economic front, the current economic cycle is far from overheating and should continue its growth trend barring an external shock of some sort. As growth continues, corporate earnings should continue to improve. Headwinds may come from the Fed as it continues to raise its fed funds rate and reduce its role in the fixed income markets. We will hear from the Fed this Wednesday when the FOMC makes its rate announcement for December, widely expected to be an increase of one quarter of one percent.

Make sure your plan has taken the potential risk of increased volatility into account.

On The One Hand

- Third quarter labor productivity increased 3.0%.

- Initial unemployment declined by 2,000 to 236,000. Continuing claims declined by 52,000 to 1.908 million.

- November nonfarm payrolls increased by 228,000. The unemployment rate held at 4.1%. Average hourly earnings have risen 2.5% on an annual basis. The average workweek in November was 34.5 hours compared to 34.4 hours in October.

On The Other Hand

- Factory orders were down 0.1% in October but the seemingly negative headline was offset by a positive revision of 0.3% for September, butting that increase at 1.7%. Factory orders, excluding transportation, rose 0.8% in October and 1.1% in September.

- The ISM Non-Manufacturing Index disappointed with a reading of 57.4 reading for November, down from October’s reading of 60.1.

- The University of Michigan’s preliminary consumer sentiment report for December was 96.8, down from the final November level of 98.5.

All Else Being Equal

Job growth was strong but wage growth lagged. The low unemployment rate and description of the labor market as tight, ignores two important facts, the low labor participation rate and the rate of underemployment (U6). While slightly higher than year ago levels, the labor participation rate continues at a low rate of 62.7%. Including the number of underemployed, the U6 unemployment rate is a relatively high 8.0%. There is considerable slack in the labor market and growth can continue without much fear of a wage push to inflation.

The Atlanta Fed’s GDPNow forecast for real Q4 GDP dipped to 2.9%.

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.