It was reported a record breaking 43,000 people attended Berkshire Hathaway’s annual meeting in Omaha on Saturday. I have not seen a count for this year’s meeting but in 2018, Yahoo Finance, who streams the meeting live, estimated 35 million viewers tuned in to watch the event online. Warren Buffett and Charlie Munger must be doing something right.

For some lessons in the fundamentals of investing, it would be well worth your time to read Warren Buffett’s February 23, 2019 Annual Letter to Shareholders and each of his annual letters since 1978. Do not be put off by the age of most of the letters. The lessons provided by Mr. Buffett are timeless.

On the One Hand

- Personal income rose 0.1% in March. Personal spending surged 0.9% in the month.

- The PCE Price Index, the Fed’s preferred gauge of consumer price increases, rose 0.2% in March, putting the March year over year rate at +1.5%, up slightly from +1.3% in February.

- The Employment Cost Index rose 0.7% for the first quarter ending in March tying the previous quarter’s rate. Both wages and salaries (70% of compensation costs) and benefits costs rose 0.7%.

- Consumer Confidence picked up in April with the index moving up to 129.2 from 124.2 in March.

- Initial unemployment claims were unchanged from the prior week’s 230,000 level. The four-week moving average was up 7,000 to 213,000. Continuing claims rose by 17,000 to 1.671 million. Weekly unemployment claims have spent more than four years below 300,000.

- The preliminary report on first quarterly productivity showed a sharp 3.6% increase, up from a downwardly revised (-0.6) fourth quarter increase of 1.3%. If it holds up, the increase will be the strongest pace since Q3 2014.

- Factory orders were up 1.9% in March and February orders were revised upward by 0.2% to a decline of 0.3%.

- April nonfarm payrolls rose by 263,000. The unemployment rate dipped to 3.6% from 3.8% in March. Other data in the employment report showed average hourly earnings up 0.2% placing average hourly earnings up 3.2% over the last 12 months. The average workweek in April was 34.4 hours, down slightly from 34.5 hours in March. The labor force participation rate remained relatively flat at 62.8% versus 63.0% in March.

On the Other Hand

- The Chicago PMI plunged to 52.6 in April from 58.7 in March placing the index at its lowest level since January 2017.

- Total construction spending dropped 0.9% in March and February construction spending was revised downward by 0.3% to a 0.7% increase.

- The ISM Manufacturing Index for April declined to 52.8% from 55.3% in March. The index, while remaining above the 50.0% dividing line between expansion and contraction, stands at its lowest level since October 2016.

- The ISM Non-Manufacturing Index continued to drift lower in April, declining to 55.5% from 56.1% in March. While holding above the 50.0% which signals expansion, the index is down to levels not seen since August 2017.

All Else Being Equal

The U.S economy remains in expansion mode even with trade troubles hampering foreign economies which rely more heavily on international trade. The October through December fears of a 2019 recession appear to have been unfounded. Continued higher employment in the U.S. combined with higher productivity growth should eventually lift construction spending which will add to the current upward cycle.

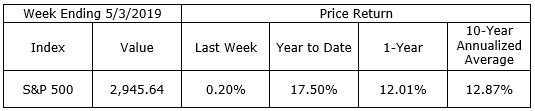

Last Week’s Market

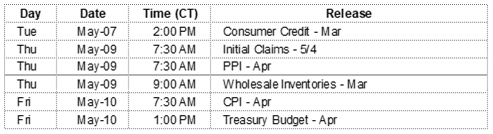

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.