Just kidding. But the fog does seem to have lifted slightly. The U.S. economy has been an island of persistent if uneven expansion in a world of sputtering growth. A pickup in international trade would help all and we picked up a few positive signs last week. Ratification of the United States-Mexico-Canada Agreement (USMCA) would be helpful. The USMCA was finally added to the agenda in Congress last week and we could see progress in the final weeks of the year. Some clarity on the direction in which Brexit will take the U.K. and Eurozone is nearer on the horizon now that the U.K.’s political position has become clearer. Finally, with few facts on the status of the trade negotiations between the U.S. and China, the December 15 round of planned tariffs was scrapped in the final hours. Even with the remaining problems, these events tip the scales toward a net positive for the economies of the world.

On the One Hand

- The Consumer Price Index (CPI) was up 0.3% in November. The annual CPI through November was up 2.1%. Retail sales are up 3.3% on an annual basis.

- The Producer Price Index (PPI) was unchanged in November, putting the annual PPI through November at 1.1%.

- Retail sales were up 0.2% in November following an upwardly revised 0.4% increase (from 0.3%) in October.

- Import prices for November were up 0.2%. Export prices were up 0.2%. On a year-over-year basis, import prices were down 1.3% and export prices were also down 1.3%.

- Total business inventories, adjusted for seasonal variations but not for price changes, were up 0.2% in the month of October and up 3.1% percent for the year ending in October. Total business sales were down 0.1% in the same month and were also down 0.1% on an annual basis. This spread between inventories and sales should keep prices in check.

On the Other Hand

- Nonfarm business sector labor productivity was revised to a decline of 0.2% in the third quarter from the previously reported 0.3% decrease. Unit labor costs increased 2.5% and have averaged 2.2% over the last four quarters. The revisions do not change the initial assessment, lower productivity and higher unit labor costs indicate profit margins are under pressure.

- For the first time since September 2017 weekly initial unemployment claims were over 250,000 at 252,000, an increase of 49,000 for the week. The four-week moving average for initial claims increased by 6,250 to 224,000. Continuing claims declined by 31,000 to 1.667 million.

All Else Being Equal

The Fed held its fed funds range unchanged at 1.75% and Jerome Powell spoke of the likelihood of little change in interest rate policy over the coming year.

The Atlanta Fed staff’s latest GDPNow estimate for real growth in Q4 stands at 2.00%. The New York Fed’s Nowcast remains in single digits at 0.7% for Q3 and 0.8% for Q1 2020.

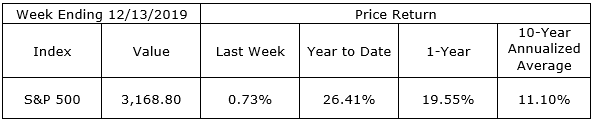

Last Week’s Market

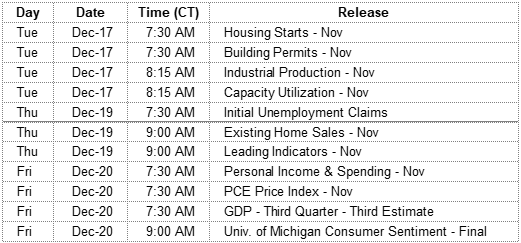

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.