After a rocky start to the week which we were told was due to the waning likelihood of a phase one agreement in the trade talks with China, the markets rebounded to finish higher. The economic news was flat to negative early in the week, but the Department of Labor’s jobs report surprised everyone Friday morning (details below). The S&P 500 was up nearly 1% on Friday, closing the week in the black and the talking heads were then telling us a China trade deal may not matter all that much. We will see how their line of thinking plays out this week, as new tariffs are scheduled to go into effect on Sunday. Whatever happens, do not let the financial press draw you into its short-term world view.

On the One Hand

- Initial unemployment claims for the week dropped by 10,000 to 203,000. The four-week moving average for initial claims declined by 2,000 to 217,750. Continuing claims rose by 51,000 to 1.693 million.

- November nonfarm payrolls increased by 266,000. October nonfarm payrolls were revised upward to 156,000 from 128,000 and September nonfarm payrolls were also revised higher to 193,000 from 180,000. The unemployment rate in November was back down to 3.5%. The U6 unemployment rate, which accounts for unemployed and underemployed workers, was 6.9%, versus 7.0% in October. November average hourly earnings were up 0.2%. Over the last 12 months, average hourly earnings have risen 3.1%. The manufacturing workweek increased by 0.1 hours to 40.5 hours. The labor force participation rate was 63.2% in November versus 63.3% in October.

- The preliminary December reading for the University of Michigan Index of Consumer Sentiment rose to 99.2 from 96.8 in November. The U.S. consumer is optimistic.

On the Other Hand

- Total construction spending declined 0.8% in October following a downwardly revised 0.3% decline (from +0.5%) in September. Private construction spending is down 1.8% year-over-year due to very weak nonresidential spending which is down 4.3% in the same period which includes a 17.7% decline in commercial spending.

- The ISM Non-Manufacturing Index declined to 53.9% in November from 54.7% in October. Still, the services sectors remain in an expansion mode, above 50.0%.

- The trade deficit for October narrowed to $47.2 billion from an upwardly revised $51.1 billion in September. The bad news is, both exports and imports declined by $0.4 billion and $4.3 billion respectively.

All Else Being Equal

The Federal Reserve will hold its December policy meeting this week. Few expect any change in the current fed funds rate which stands at 1.75% at the upper end of its range. Many analysts believe it will not change through most of 2020 and this is likely based on the Fed’s history of standing pat during election years.

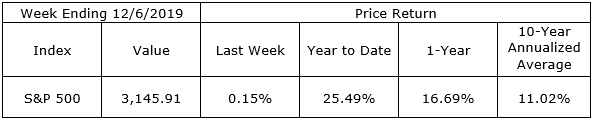

Last Week’s Market

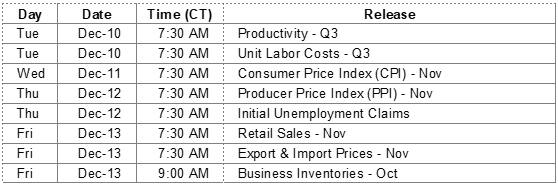

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.