“We’ve long felt that the only value of stock forecasters is to make fortune tellers look good.”

This Warren Buffett observation came to mind again last week when the market failed to crash when voters elected Donald Trump president of the United States. This is the second time in five months market tea leaf readers failed. The first was after the Brexit vote in June when markets were supposed to crash. Investors should avoid taking the market mystics seriously.

What We Are Watching So You Don’t Have To

On The One Hand

- Total outstanding consumer credit increased by $19.3 billion in September after increasing an upwardly revised $26.8 billion in August. This data supports a continuing expansion of the U.S. economy.

- Wholesale inventories increased 0.1% in September. The August number was revised upward to a 0.1% decline leaving inventories flat over the last two months. Wholesale sales were up 0.2% on top of an unrevised 0.7% increase in August. This is a preview of the full business inventories report which will be released on Tuesday, the 15th.

- In the week ending November 5th, initial claims declined 11,000 to 254,000.

- The Mortgage Bankers Association (MBA) released its weekly report on mortgage applications Wednesday morning, noting a week-over-week decrease of 1.2% in the group’s seasonally adjusted composite index for the week ending November 4th. Last week’s average mortgage loan rate for a conforming 30-year fixed-rate mortgage increased from 3.75% to 3.77%.

- The University of Michigan Preliminary Consumer Sentiment for November came in at 91.3, up from the October Final reading and higher than the 2016 average. The Index in early November erased the small October decline to climb to its highest level since mid- 2016 and rose slightly above the 2016 average of 91.1

On The Other Hand

The Job Openings report (JOLTS) declined slightly to 5.36 million from 5.45 million. Hires edged down to 5.1 million, and total separations were little changed at 4.9 million.

All Else Being Equal

After yielding as little as 1.37% during the summer, the 10-Year Treasury Note yield rose back up to the 2.15% level where it started the year. Economic data as a whole continues to show growth although slow and erratic. The path to a Fed rate hike in early December seems clear.

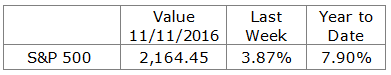

Last Week’s Market

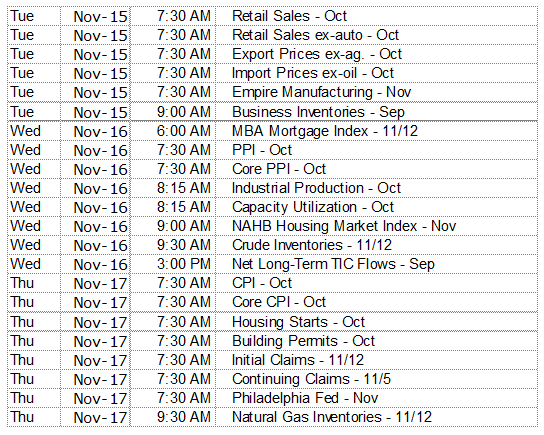

The Week Ahead