The first four trading days of January got the market off to a good start for the year and the January Barometer followers are again touting the success of their indicator. Proponents claim since 1950, the direction of the market for the year has been predicted by the direction of the market during the month of January with 87.7% accuracy.

An article in today’s Wall Street Journal notes the time periods over which Barometer is measured raise doubt as to Barometer’s value as a predictor. Since 1972, the year in which the January Barometer was first described, January’s market action accurately forecast the direction of the market 64% of the time. Even this sounds like it may be useful until the author goes on to point out if there had been an indicator which predicted the market would go up every year, it would have been right 76% of the time over the same time period.

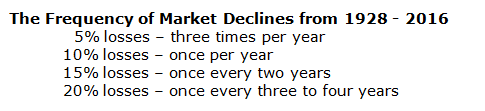

So the old saying, “time in the market is more important than timing the market”, might be a more useful rule for success over the lifespan of our financial plans. Considering recent gains and all of the time we will spend in the market, it is worth reviewing another set of market facts:

These too are simply averages. The timing of these downdrafts cannot consistently be predicted. In order to shield our actions from our emotions and biases we need to remind ourselves declines happen regularly. It is also worth noting during every one of the larger declines we heard, “… but this time is different”. So far, they have all been the same and our portfolios survived and grew. We must keep our emotions in check as the year progresses.

What We Are Watching So You Don’t Have To

On The One Hand

- Total construction spending increased 0.9% in November, nearly twice the consensus expectation. In addition, October was revised upward to 0.6% from 0.5%. Annually, total construction spending increased at a seasonally adjusted rate of 4.1%.

- The ISM Manufacturing Index rose to 54.7 in December, up from 53.2 in November, and finished at its highest level of the year.

- U.S. light vehicle sales in December were a seasonally adjusted annual rate of 18.43 million units, 5.2% above the December 2015 rate of 17.52 million units.

- Initial jobless claims declined 28,000 to 235,000 for the week ending December 31. Continuing claims for the week ending December 24 increased by 16,000 to 2.112 million.

- The ISM Non-Manufacturing Index for December was unchanged from the November release of 57.2.

- December nonfarm payrolls increased by 156,000, below expectations. The disappointment was offset by revisions in November payrolls which increased to 204,000 from 178,000 and October which were revised lower to 135,000 from 142,000. The unemployment rate was 4.7%.

- December average hourly earnings increased 0.4%. Average hourly earnings have risen 2.9% over the last twelve months. The average workweek was 34.3 hours.

On The Other Hand

- The Trade Balance widened in November to $45.2 billion from a revised deficit of $42.4 billion for October. November exports were $0.4 billion less than October exports and imports were $2.4 billion greater than October imports.

- New orders for manufactured goods declined 2.4% in November. October orders were revised upward to +2.8% from +2.7%.

All Else Being Equal

Brian Wesbury, Chief Economist at First Trust provides some additional thoughts on trade, the petroleum market, GDP growth.

Another ongoing factor affecting trade with the rest of the world is the trend decline in US petroleum product imports. Although the dollar value of petroleum imports increased 7.6% in November, and are up 15% from a year ago, we don’t expect this to last. Since OPEC decided to cut oil production, prices have increased north of $50. As a result, expect more oil production to come back online in the United States and the petroleum import trend to revert lower. Back in 2005, US petroleum and petroleum product imports were eleven times exports. In November, these imports were 1.7 times exports. This is also why oil prices have not spiked back to old highs even though the Middle East is in turmoil. The US has become an important global petroleum producer, bringing a stabilizing effect to the world. Overall, we expect real GDP growth to accelerate in 2017 and expect some widening in the overall trade deficit as US consumers buy imports with their healthy gains in income. This will happen despite efforts by the incoming president to reverse the trade gap, which is ultimately driven by capital flows into the US. If we make the US a better place to invest global capital – and it’s likely President Trump and Congress will do that – the overall trade deficit will grow, not shrink.

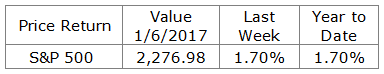

Last Week’s Market

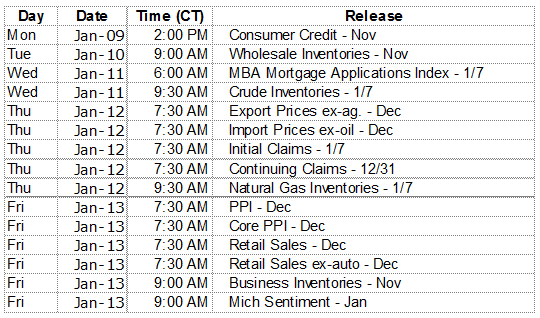

The Week Ahead