While the press has featured warnings of current stock market overvaluation, Stephen Auth of Federated Investors, makes the case for buying any dips in this secular bull market. Three of the points he makes are noted below while his full Market Memo can be found here.

- … the market continues to look relatively inexpensive if not outright cheap. Our earnings forecast for the S&P for 2018, … is $140 per share. This represents a 16.7 P/E multiple at current levels, whereas the market historically has traded closer to 18 in low-inflation environments such as we presently have. Eighteen times $140 gives you 2,520.

- Earnings growth has turned, and we expect this quarter’s season to surprise to the upside. Drivers include the interest-rate bumps we’ve already gotten and relatively strong capital-markets activity (good for the financials); the renewed upturn in the U.S. oil patch on the back of oil price stability in the $50/barrel range (good for energy, industrials and transport stocks); the reversal in dollar strength (down almost 4% in the first quarter); and the overall uptick in confidence among consumers and businesses since the election. The earnings season for sure got off to a solid start with the big three bank earnings released earlier this month. More to come, we expect.

- The market seems to be misunderstanding the impact of the Fed’s early interest rate hikes off of what have been crisis levels. Most studies on the impact of interest-rate hikes presume the starting point is “normal.” However, in the present environment, the starting point is “way below normal.” From the zero level, early hikes improve financial market conditions rather than slow them (i.e., banks begin to make money again and lend more from their bloated reserves; consumers earn more from their savings accounts and have more disposable income). Combined with the Chair Janet Yellen’s innate dovishness, we see the Fed as more in the position of pouring gasoline, not water, on the fires of economic reacceleration.

On The One Hand

- Industrial production increased 0.5% in March. Utilities production rose sharply, 8.6%. While factory output declined for the month, it was 2.7% higher year over year in the first quarter.

- Capacity utilization increased to 76.1%, up from 75.7% in February. On the other hand, capacity utilization remained below its long term average of 79.9%.

- The weekly initial unemployment claims report showed an increase of 10,000 to 244,000, a relatively low level and under the 300,000 mark which would raise concerns about the health of the jobs market. Continuing claims decreased by 49,000 to 1.979 million, the lowest level for continuing claims since April 15, 2000.

- The leading economic indicators increased 0.4% in March following the February increase of 0.5%. The Coincident Economic Index increased 0.2% in March as it did in February.

- Existing home sales increased 4.4% in March to a seasonally adjusted annual rate of 5.71 million units. The inventory of existing homes for sale increased 5.8% from the previous month, to 1.83 million units. Inventory however is down 6.6% from year ago levels, a 3.8-month supply at current sales versus a normal level of 6.0-months’ supply.

On The Other Hand

- Housing starts came in at a seasonally adjusted annual rate of 1.215 million units, down 6.8% from the 1.303 million reported for February.

- Building permits were 3.6% higher to a seasonally adjusted annual rate of 1.260 million but the increase came from for multi-unit dwellings. Single family permits were unchanged or lower and were down 5.9% in the Midwest.

- The Philadelphia Fed Index declined from 32.8 in March to 22.0 in April. Anything above zero indicates expansion in manufacturing activity in the Philadelphia Fed region.

All Else Being Equal

Monitoring the U.S. economy continues to be as exciting as watching grass grow. It is growing however and moderate growth is not necessarily problematic.

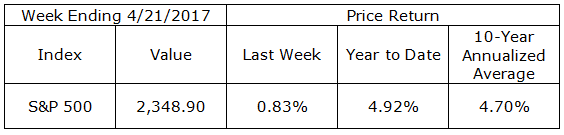

Last Week’s Market

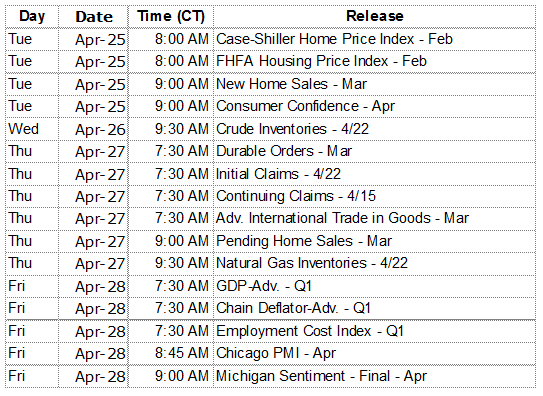

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.