To paraphrase Benjamin Franklin, by failing to plan, you are planning to fail. Your vision of life for you, your family, your friends and community has many facets. Education, health, work, wealth and charity are examples of personal planning issues which require planning. Change is constant and as a result your vision will adjust to various uncontrollable changes over time. A good financial plan and estate plan will be like a bridge, robust and flexible at the same time. Great plans, in order to stay great, will have to be reviewed and refined over time.

Steve English, the founder and CEO of The Trust Company of Kansas, has posted an excellent piece on estate planning considerations. Please take a look the helpful article, Building a Dynamic Estate Plan, then contact your trust officer if you have more questions.

On The One Hand

- The Conference Board’s Consumer Confidence Index in July increased to 121.1, beating the consensus guess of 116.8 and the June level of 117.3.

- New single-family home sales rose 0.8% in June to a 610,000 annual rate. Sales are up 9.1% from a year ago.

- Durable orders for June rose 6.5%. On a year-over-year basis, orders are up 5.0%.

- Initial unemployment claims rose 10,000 to 244,000 keeping the volatile weekly count well under the 300,000 warning level. Continuing claims decreased by 13,000 to 1.964 million.

- The first estimate for second quarter real GDP growth is 2.6% at an annual rate. The largest positive contribution to real GDP growth in Q2 was consumer spending. The largest drag was home building.

On The Other Hand

Existing home sales declined 1.8% in June to a 5.52 million annual rate. Sales are up 0.7% versus a year ago.

All Else Being Equal

Brian Wesbury and his team at First Trust provide a nice summary of the current state of the economy. “The best news in this week’s Q2 GDP report was that for the second straight quarter, we had an increase in each major part of business investment – investment in equipment, commercial construction, and intellectual property. That change signals greater business optimism about the future and, if it’s sustained, will translate into faster measured productivity growth and economic growth in the next few years. We like to follow “core” real GDP, which excludes inventories, international trade, and government purchases, none of which can generate long-term economic growth. Core real GDP grew at a solid 2.7% annual pace in Q2, and that includes a drop in home building at a 6.8% rate that’s likely to reverse in the quarters to come, given strong fundamentals in that sector. In the past year, core GDP is up 2.8%. In terms of the Federal Reserve, nothing in today’s report should alter the likely path of monetary policy over the next year or so. Nominal GDP (real GDP growth plus inflation) rose at a 3.6% annual rate in Q2, is up 3.7% in the past year, and up at a 3.1% annual rate in the past two years. All of these figures suggest short-term interest rates should be higher than the roughly 1% where they are today. Look for the Fed to stay on the path to raising rates again by December and initiating reductions to the size of the balance sheet at the next meeting in late September. Although investors have their doubts about another rate hike later this year, we think those doubts will recede in the next couple of months. Slow inventory investment has been holding back the economy in the first half of 2017. We expect inventories to grow in the second half and for real GDP to grow faster as well. It’s early, but right now we’re penciling in a real GDP growth rate of 3%+ in the second half.”

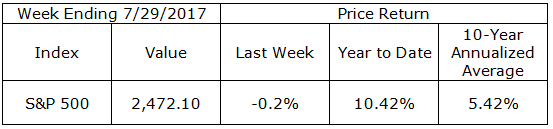

Last Week’s Market

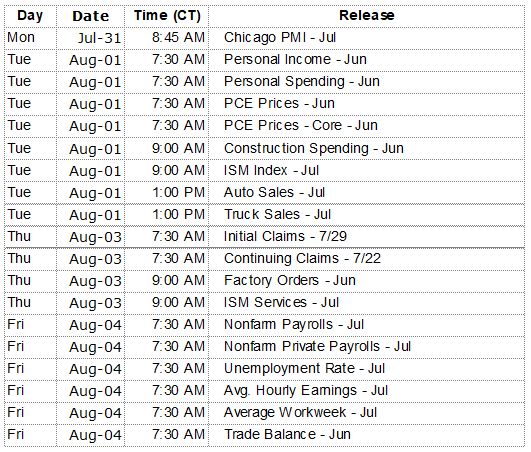

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.