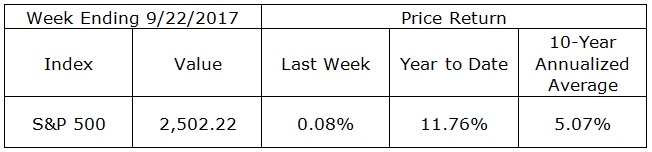

September is on track to beat the averages this year. As we begin the final week of the month and quarter, the S&P 500 is up 1.24% month to date and 3.25% quarter to date. Year to date, the price return of the S&P 500 stands at 11.76% as of Friday’s close. This is quite a setup as we head into the fourth quarter, historically the best quarter of the year, with its average gain of four percent plus or minus. The S&P 500 has experienced a lower fourth quarter in just 14 of the last 67 years. The last down Q4 was in 2012 when the index finished off 1.01% for the quarter. The preceding negative Q4 occurred in 2008 when the liquidity crisis sent the S&P 500 down 22.56%. Past performance is no guarantee.

I normally do not write about quarterly stock market returns and seasonality in this weekly note. These and similar short term issues are the focus of traders, not investors. At the same time, stock market history and statistical phenomena are fascinating topics. Although, don’t let them draw your attention away from the important things. Success in both investing and trading requires well developed processes and strict adherence to those processes. It is important to realize trading processes and investment processes are very different, however, and allowing trading processes to sporadically influence long term investment decisions is rarely successful. If you are an investor, do not let yourself be drawn into the trader’s world.

Interest rates firmed again last week. Treasury yields on the 2-Year finished the week at 1.44% versus 1.38% the previous week and the 10-Year closed the week at 2.26% up from 2.20%. The Federal Reserve is on track to raise its Fed Funds rate another 1/4%, probably in December. Additional upward pressure on market rates is expected to gradually increase as the Fed begins its long awaited balance sheet reduction. The reduction will be accomplished by halting reinvestment of a portion of the proceeds from maturing bonds in its portfolio. This roll off will start very small, at the rate of $10 billion per month, beginning in October. These are long planned and much discussed actions so there is no reason for investors to get spooked.

We will be taking a break from the Weekly Update for the next two weeks. During this period, check the Updates link on our homepage each week for the Thursday Thoughts article. Each of these articles will address a current topic in the area of financial planning, tax planning and estate planning. The Weekly Update will return Monday, October 16.

On The One Hand

- Building permits rose 5.7% to a seasonally adjusted annual rate of 1.300 million.

- Import prices were up 0.6% in August, up 2.1% for the past 12 months. Export prices also rose 0.6% for the month which put the year-over-year increase for export prices at 2.3%.

- Initial unemployment claims, for the week ending September 16, declined by 23,000 to 259,000. Continuing claims increased by 44,000 to 1.98 million.

- The Philadelphia Fed’s manufacturing index increased substantially in September with a reading of to 23.8, up from 18.9 in August. This was the 14th month the index has been above zero, the dividing line between expansion and contraction.

On The Other Hand

- Housing Starts for August declined 0.8% to a seasonally adjusted annual rate of 1.180 million. Total starts are up just 1.4% versus a year ago. The weakness has been in multi-family starts. Single-family starts increased 1.6% for August. In the past year, single family starts are up 17.1% while multi-unit starts are down 24.7%.

- Existing home sales declined 1.7% in the month of August to a seasonally adjusted annual rate of 5.35 million. Existing home sales were up just 0.2% from year ago levels.

All Else Being Equal

The initial effects of Hurricanes Harvey and Irma on the economy are beginning to show up in the data in a negative way. The temporary slowdown in activity caused by the storms may continue to affect the data releases through October when postponed consumer and business activity along with the rebuilding effort begin to swing the data in a more positive direction.

The slow expansion base case for the economy continues. The Atlanta Fed’s GDPNOW estimate for GDP growth in the 3rd quarter held steady at 2.20%. The New York Fed’s “Nowcast” for Q3 GDP growth is 1.6%.

Last Week’s Market

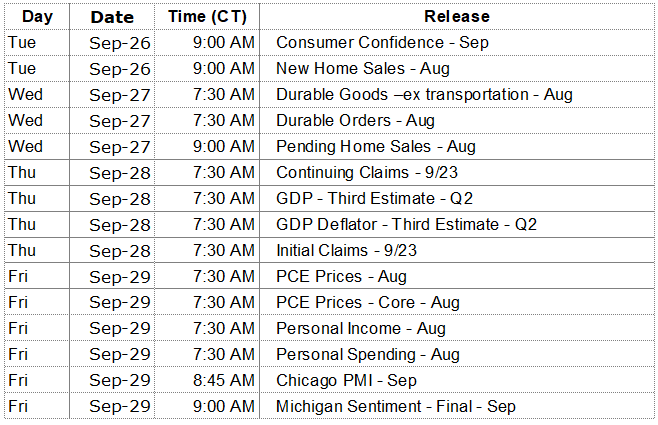

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.