Earlier this month, psychologist and economist Richard Thaler was awarded the 2017 Nobel Prize in economics for his work in the field of behavioral economics. The study of the psychology of economics is of questionable value in the minds of many traditional economists. Economists have long struggled to have their field of study accepted as a true science and these upstarts, by adding the study of human behavior to the mix, have only set them back. The field continues to be a long way from science. By this, I mean models of physical laws and mathematics allow us to land humans on the moon and return them to Earth. Economic models, on the other hand, cannot design steadily growing economies with full employment. Nor have they been able to prevent financial liquidity meltdowns like the one of 2008-2009. Sadly, economists are doomed for the time being to be defined by the likes of John Kenneth Galbraith who said, “The only function of economic forecasting is to make astrology look respectable.”

Putting these professional debates aside, the work of behavioral economists has provided extremely useful insights into human behavior which if studied, can help each of us become better consumers and investors. The work can help us understand why the young, in good conscience, do not save enough for retirement. It sheds light on why most people, reacting normally to natural human instinct, continually make poor business and investment decisions. Read a few examples on our web site in the article, Emotional Investing.

On The One Hand

- The Producer Price Index (PPI) rose 0.4% in September and is up 2.6% versus a year ago. Energy prices rose 3.4% in September, while food prices were unchanged. In the past year, prices for goods are up 3.3%, while prices for services are up 2.1.

- Initial unemployment claims for the week declined by 15,000 to 243,000. Continuing claims declined by 32,000 to 1.889 million, the lowest level since December 29, 1973.

- Retail sales in September were up 1.6%. Retail sales are up 4.4% versus a year ago.

- The Consumer Price Index (CPI) rose 0.5% in September, slightly below the consensus expected increase of 0.6%. The CPI is up 2.2% from a year ago.

- The University of Michigan’s preliminary consumer sentiment index rose sharply to a 13-year high of 101.1 in October from 95.1 in September. Optimism was evident from the large gains in both the index for current economic conditions, which rose to 116.4 from 111.7, and the index for expectations, which rose to 91.3 from 84.4.

- Business inventories rose 0.7% in August; July was revised upwardly to a 0.3% increase from the originally reported 0.2%. The inventories-to-sales ratio held steady at 1.38, down from 1.40 in the same period a year ago.

On The Other Hand

There was no significant negative data last week.

All Else Being Equal

Jobs and wages continue to show improvement. Consumers’ financial obligations are a manageable part of their incomes and serious debt delinquencies are down substantially from seven years ago.

The Atlanta Fed’s GDPNow model forecasts real fourth quarter GDP growth of 2.7%. The New York Fed’s Nowcast model increased its estimate for real Q4 economic growth by 0.4% to 2.9%. The Federal Reserve is on course to raise the fed funds rate again in December.

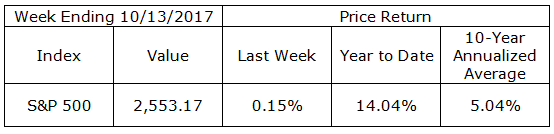

Last Week’s Market

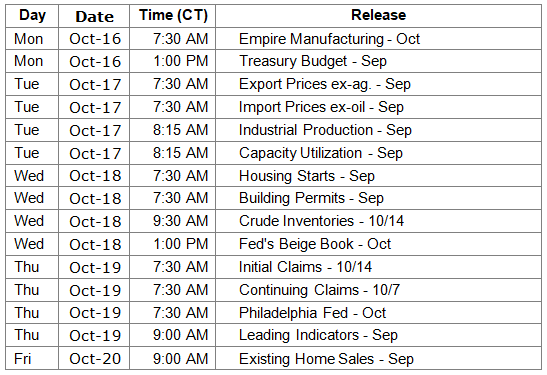

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.