It will be a busy week for the markets. Hundreds of companies will be releasing third quarter earning’s reports. Continued favorable news from Washington on tax reform is anticipated. On Friday, the preliminary report on third quarter Gross Domestic Product will be released.

Short term interest rates have been on the rise as can be seen by the yield on the 2-Year Treasury which finished the week at 1.57%, a level not seen since October 2008. This increase has not been matched by intermediate and long term rates. The 10-Year Treasury yield closed the week with a yield of 2.39% which remains below the 2.59% yield of just one year ago.

Regardless of this week’s news and interest rate levels, focus should not shift away from our personal financial goals. A few of our goals may be short term but the vast majority will not be affected by a week’s worth of financial news, interest rate fluctuations or stock market activity. To help focus our thinking, David Ross has posted an article, Retirement Readiness, on our web site. The emphasis should always be on one’s personal goals and the processes necessary to attain them.

On The One Hand

- As expected, industrial production rebounded in September, posting broad-based gains despite the Florida hurricane. Industrial production rose 0.3% in September and is up 1.6% versus a year ago. Capacity utilization rose to 76.0% in September from 75.8% in August.

- The Export/Import Price Index for September posted a 0.7% increase in import prices and a 0.8% increase in export prices. On an annual basis, import prices are up 2.7% and export prices are up 2.9%.

- Initial jobless claims fell 22,000 last week to 222,000, the lowest reading since 1973. Continuing claims were also the lowest since 1973, falling 16,000 to 1.89 million.

- The Philly Fed Index, a measure of sentiment among East Coast manufacturers, rose to 27.9 in October, up from 23.8. The increase and reading above the neutral zero reading signals optimism in that part of the country.

On The Other Hand

- Housing starts declined 4.7% in September to a 1.127 million annual rate, well below the consensus expected 1.175 million. Starts are up 6.1% versus a year ago.

- New building permits were reported below expectations, declining 4.5% in September to a 1.215 million annual rate.

- The index of leading economic indicators declined 0.2% in September, the first drop in 12 months.

- Existing home sales rose 0.7% in September to a seasonally adjusted annual rate of 5.39 million The September pace is 1.5% below year ago levels.

All Else Being Equal

Some of the U.S. economic data continues to be negatively affected by the temporary impact of the recent hurricanes. These anomalies may appear in this week’s release of the preliminary third quarter GDP report on Friday. The Atlanta Fed’s GDPNow estimate is for real growth of 2.7%. The New York Fed’s Nowcast estimate declined after last week’s data to growth rate of just 1.5%. Whatever Friday’s number is, remember two things: the Q3 GDP number will be revised several times before it goes into the record book; and third quarter data is history, meaning consumers, employees and employers are planning based on current and anticipated activity, not on what occurred in July, August and September.

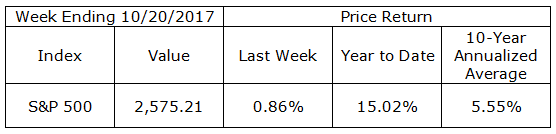

Last Week’s Market

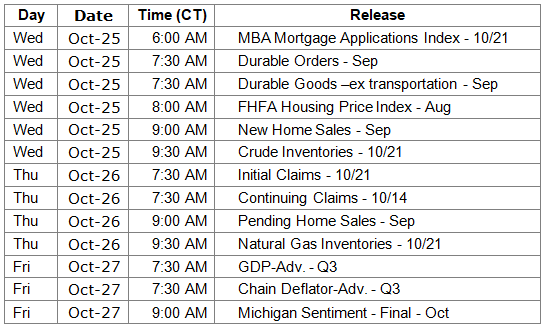

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.