The S&P 500 finished the week at 2,675.81, another new high. Year-to-date, the index is up 19.52% and if the year had ended on Friday it would have been the 4th largest calendar year gain for the index so far in this century. If the index can at least hold onto its current month-to-date gain of 1.49%, December will be the ninth month in a row of up months; a string of monthly gains not seen since the 1950s.

On the interest rate front, the Fed raised short term rates by 0.25% setting the fed funds range at 1.25% to 1.50%. One year ago the fed funds range was 0.50% to 0.75%. The yield on the 2-Year Treasury has risen from 1.20% at the beginning of the year to 1.85% on Friday afternoon. Yields are lower on the 10-Year Treasury which finished the week at 2.36%, down from its 2.45% yield at the end of 2016.

On The One Hand

- The Producer Price Index (PPI) increased 0.4% in November. On an annual basis, the PPI was up 3.1%. The increase was in line with expectations and evidence of an expanding economy.

- As expected, the Consumer Price Index (CPI) for November increased 0.4%. On a year-over-year basis, the CPI was up 2.2%. The price reports are not signaling the start of runaway inflation.

- The Fed raised short term rates 0.25 percent. The federal funds rate is now in a range of 1.25% to 1.50%.

- Retail sales increased 0.8% in November, beating the consensus expected 0.3% gain. Retail sales are up 5.8% versus a year ago. In addition, October sales were revised higher by 0.3 percent to +0.5%.

- Weekly initial unemployment claims decreased by 11,000 to 225,000 and continuing claims declined by 27,000 to 1.886 million.

- As expected, industrial production returned to a more moderate growth rate, rising 0.2% following the upwardly revised 1.2% increase in October. The capacity utilization rate at 77.1% was up slightly from 77.0% for October.

On The Other Hand

The Wall Street Journal reported 4.6 million Americans are severely behind on payments on federal student loans, double the number from four years ago. At the end of the third quarter, defaulted student loans totaled $84 billion, or 13% of the $631 billion in repayment status.

All Else Being Equal

President Harry Truman on economists: I was in search of a one-armed economist so that the guy could never make a statement and then say, “on the other hand”.

Consumers were spending and price increases were moderate as we moved into the important retail season. The Fed is satisfied the expansion is healthy enough to normalize short term interest rates. In the latest release, the Atlanta Fed raised its Q4 real GDP forecast to 3.3% growth.

Last Week’s Market

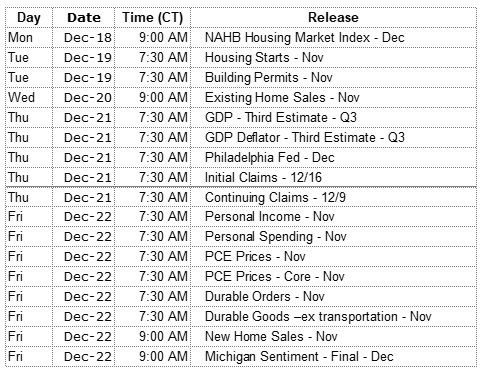

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.