As of Friday, 80% of companies in the S&P 500 have reported fourth quarter 2017 results. The blended earnings growth rate for the quarter has been 15.2% year-over-year and is the highest reported since 2011. FactSet reports 2018 earnings per share growth estimates have increased by 7%. In addition, from Dec. 31 through Feb. 15, the number of S&P 500 companies announcing positive guidance for 2018 was 127, a record-high number. Growing earnings and continued moderate inflation support stock prices.

On The One Hand

- Total business inventories increased 0.4% in December leaving year-over-year growth at a gain of 3.2%. Total business sales increased 0.6% putting the annual sales growth rate at 6.7%.

- Initial unemployment claims for the week were up 7,000 to 230,000. Continuing claims increased 15,000 to 1.942 million.

- Manufacturing activity in the Philadelphia Fed region is accelerating as confirmed by an increase in new orders and firming prices. The Philly Fed Index increased from 22.2 in January to 25.8 in February.

- Housing Starts increased 9.7% in January to a seasonally adjusted annual rate of 1.326 million. Building permits rose 7.4% to a seasonally adjusted annual rate of 1.396 million.

- Preliminary Consumer Sentiment (University of Michigan) for February rose to 99.9 from the final January reading of 95.7.

On The Other Hand

- The Consumer Price Index (CPI) for the month of January came in hot with an increase of 0.5%. From a big picture perspective the index is up at an annual rate of 2.1% over the past 12 months.

- Average hourly earnings declined 0.2% in January. The annual increase in hourly earnings is up just 0.8% in the past year.

- Retail sales declined 0.3% in January and were down 0.7% taking revisions to prior months’ revisions. For the past 12 months, retail sales are up 3.6%.

- The Producer Price Index increased 0.4% in January and is up 2.7% year-over-year.

- Industrial production dropped 0.1% in January and December was revised lower by 0.5% to a 0.4% increase. Capacity utilization dropped to 77.5% from a downwardly revised 77.7% December.

- Import prices increased 1.0% in January while export prices increased 0.8%.

All Else Being Equal

The week’s price index data sparked talk of greater inflation leading to larger and faster interest rate increases. The existing data supports the Fed’s existing plan for another three rate increases in 2018 with a fourth rate hike more likely than not.

Retail sales and industrial production started the year on a soft note. Housing starts, building permits and consumer sentiment provided positive signs. The Atlanta Fed’s volatile GDPNow estimate for real Q1 GDP growth now stands at 3.2%. A Wolters Kluwer Survey of 52 economists in early December estimated an average estimate of 2018 real GDP growth of 2.6%. We remain on track to realize that estimate and one week’s worth of monthly data will produce little or no change to long term economic models.

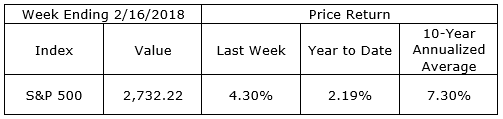

Last Week’s Market

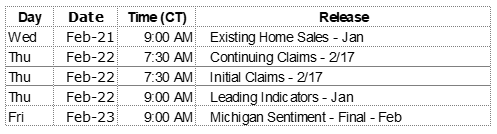

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.