There are few sources of enduring investment truths as dependable as Warren Buffett. Last week’s update pointed out the necessity of identifying the different risks associated with the varying time horizons a portfolio might have. The main point was, in a long term portfolio, the risk of the compounding loss of purchasing power as a result of even low rates of inflation is by far the greatest risk an investor faces. Today, we will point out one last timeless truth mentioned by Mr. Buffett in his 2017 annual letter to Berkshire Hathaway shareholders.

Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential.

Markets do crazy things over periods of days, weeks and even long stretches of months. During such periods financial pundits say crazy things. Successful investors filter out such noise and stay focused on the long term fundamentals.

Disregarding the mob’s enthusiasm or its fears is a simple mission which, for many, can be very difficult to carry out. In addition to our capacity to think and act logically long term, as humans, we have emotions and instincts which, while very useful in protecting us from sudden, short term threats, can overwhelm our thinking and logical selves at times. Buffett’s admonishment to ignore the noise and stay focused on the fundamentals is critical. It does take effort and it may be uncomfortable for a time as the mob around us reacts to short term craziness. Ignoring the pundits will seem foolish to some and they will ease their pain by buying at market tops or selling at market bottoms. Those who cannot separate their long term thinking from their short term thinking will feel immediate relief as they join the crowd. Shifting their focus away from the simple fundamentals, however, will nearly always have a negative effect on their long term portfolio returns.

On The One Hand

- The Consumer Confidence Index rose to 130.8 in February from a downwardly revised 124.3 in January.

- The Richmond Fed’s index of mid-Atlantic factory sentiment rose sharply to 28 in February from its January print of 14.

- Personal income rose 0.4% in January and personal consumption increased 0.2%, both in line with expectations. For the past year, personal income is up 3.8%, while spending is up 4.4%. The PCE Price Index was up 1.7% on an annual basis.

- Initial unemployment claims for the week dropped by 10,000 to 210,000 putting the four-week moving average at 220,500. Both figures were levels not seen since December 1969. Continuing claims rose 57,000 to 1.931 million.

- The ISM Manufacturing Index for February continued to signal expansion with another reading above 50. The index was reported at 60.8, up from the January reading of 59.1.

- Construction spending was unchanged in January leaving annual total construction spending up 3.2%.

On The Other Hand

- New single-family home sales declined 7.8% in the month of January. The seasonally adjusted annual rate of 593,000 was 1% below year ago levels. Keep in mind year ago levels were at a ten year high.

- New orders for durable goods declined 3.7% in January and were revised lower by 0.1% for prior months. Orders remain 6.8% higher than year ago levels.

- The second estimate for 2017 Q4 GDP was revised downward to 2.5% from 2.6%. The GDP Price Deflator was also revised downward to 2.3% from 2.4%.

- The Chicago PMI, which measures manufacturing sentiment in that region, declined to 61.9 in February, down from 65.7 in January.

- U.S. light vehicle sales were at a seasonally adjusted annual rate of 17.08 million units in February, 2.1% below run rate for February 2017. On an annual basis, the sales rate was 0.9% below the year-ago period.

- The Consumer Sentiment index for February, at 99.7, was above the January reading of 95.7 and continues at a multi-year high level.

All Else Being Equal

The new Fed Chairman, Jerome Powell, appeared before committees of both houses of congress last week and the House and Senate last week. His pronouncements were as expected. The economy is growing. There are no signs of overheating. There is no evidence of a strong increase in inflation. The new tax law should lead to higher investment which will lead to higher productivity and ultimately higher wages over time. There are no changes to previously announced Fed rate hikes and balance sheet reduction.

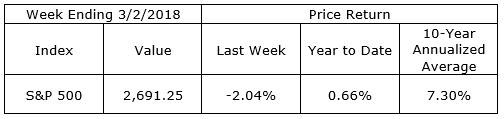

Last Week’s Market

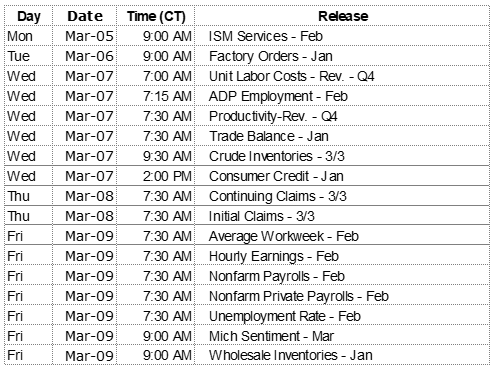

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results