Market prices constantly adjust to new information. Later this week we will begin receiving new, meaningful information as first quarter corporate earnings begin to trickle in. Reporting will be in full swing next week and continue through the month. We will soon be able to update the “E” in P/E multiples. Expectations are for S&P 500 profits to be higher by something on the order of 18%. One would think most of that level of earnings growth is already reflected in current stock prices. Traders will be reacting, however, to earnings surprises above or below these expectations. Nothing will come from the quarter’s earnings reports and traders’ reactions to provide a basis to change long-term financial and investment goals, even though they will be interesting.

On The One Hand

- The ISM Manufacturing Index came in at 59.3 for March, down from 60.8 for February. While lower, the index remains well above 50, the dividing line between expansion and contraction.

- Total construction spending rose 0.1% in February following January’s no-growth report. Year-over-year, construction spending was up 3.0%.

- Automakers beat expectations in March by reporting sales at an annual rate of 17.5 million cars and light trucks, up 2.4% from February, and up 3.9% from a year ago.

- ADP employment reported 241,000 added jobs in March. This was ADP’s fifth consecutive month reporting employment growth in excess of 200,000.

- Initial jobless claims rose 24,000 last week to 242,000. Continuing claims declined 64,000 to 1.808 million, the lowest since 1973. Initial claims have now tied the longest streak of readings under 300,000.

On The Other Hand

- The February Trade Balance Report did little to reduce trade deficit concerns. The deficit widened $57.6 billion from $56.7 billion in January. The trade deficit is the largest it has been since October 2008.

- Nonfarm payrolls rose 103,000 in March. Including revisions to the January and February figures, payrolls were up just 53,000. The unemployment rate remained at 4.1%. A bright note in the report, average hourly earnings rose 0.3% in March and are up 2.7% versus a year ago.

All Else Being Equal

The latest payrolls report disappointed but the downturn in this volatile monthly report was not likely the signal of a significant change in the growth trend. On average, payrolls are up 188,000 per month over the last year, and not far off the 190,000 monthly average for the 12 months ending March 2017.

The new data brought about a one-tenth of one percent reduction in the Atlanta Fed’s estimate for real Q1 GDP growth putting it at 2.3%. The New York Fed estimate was adjusted upward by 0.1% to 2.8%.

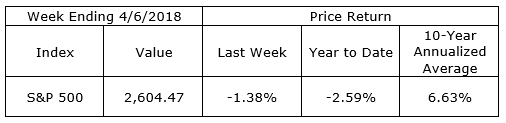

Last Week’s Market

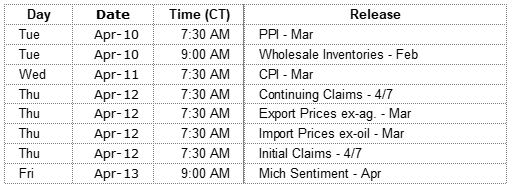

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.