After establishing and prioritizing the importance of well-defined goals, we will turn our attention to creating a personal financial statement and budgeting for attainment of current and future objectives. The next stage is an assessment of the types of savings and investment plans or accounts available. A primary difference among the account types available is the impact of our complicated income tax code. The fact there are so many different types of account options is proof of the tax code complexity investors face. Step #3 below provides a broad overview of the possibilities. If you can effectively tackle this step and remain in the do-it-yourself camp, you should seriously consider becoming a professional fiduciary yourself. If you find your time is better spent focused on your profession, family, health, recreation, hobbies, volunteer work, and philanthropy – you may need a fiduciary.

- Establish financial objectives and determine the time frame associated with each one.

- Determine the amount of savings which will be necessary to fund the investment accounts sufficiently.

- Determine the types of investment accounts available to best take advantage of provisions in the tax code.

- Understand and participate in your employer’s retirement plan. If you are self-employed learn the features of the many types of retirement plans you can adopt. You will encounter terms and acronyms such as: Defined Benefit; Defined Contribution; SEP; SIMPLE; 401(k); 403(b); Thrift Savings.

- Determine whether you can contribute to traditional Individual Retirement Accounts (IRAs) and Roth IRAs and if so, what your contribution limits are.

- Understand rollovers, direct transfers, and conversions which can take place between many of the account types noted in a. and b., above.

- Establish taxable investment accounts with after-tax dollars.

- Consider the best options for funding educational needs. A 529 Plan may be your best option.

- Know the tax benefits and limitations which may be derived from making contributions to each of the account types. Become familiar with the impact of taxes on and withdrawals from each account type.

- Identify investment classes and determine the realistic expected returns each might generate over the spans of time associated with each objective.

- Identify the risks involved with investing in each of the available asset classes.

- Determine when cash outflows need to begin and from which type of account it should be withdrawn.

On The One Hand

- The Consumer Confidence Index increased to 128.0 in May following a downward revision of April’s reading to 125.6 from 128.7. The index stands at a 17 year high.

- The GDP price deflator for the first quarter was revised downward to 1.9% from 2.0%.

- Personal income rose 0.3% in April and is up 3.8% in the past year. Personal consumption increased 0.6% in April and is up 4.7% in the past year. The PCE deflator rose 0.2% in April and is up 2.0% versus a year ago.

- Initial unemployment claims fell 13,000 last week to 221,000. Continuing claims declined 16,000 to 1.73 million.

- The Chicago PMI, which measures manufacturing sentiment in that region, rose to 62.7 in May from 57.6 in April.

- Nonfarm payrolls rose 223,000 in May. Including revisions to March/April, nonfarm payrolls increased 238,000. The unemployment rate declined to 3.8%. Average hourly earnings (cash earnings, excluding irregular bonuses/commissions and fringe benefits) rose 0.3% in May and are up 2.7% versus a year ago.

- The ISM Manufacturing Index rose to 58.7 in May, beating the consensus expected 58.2 and remaining above 50.0 which is a signal of expansion. The manufacturing sector is having its best year since 2004.

- Construction spending rose 1.8% in April. A surge in April home building and a pickup in spending on power projects more than offset a decline in commercial construction.

On The Other Hand

- The first quarter GDP growth rate was revised downward slightly to 2.2% from 2.3%.

- Pending home sales declined 1.3% in April after a 0.6% gain in March and 2.8% rise in February.

All Else Being Equal

There has been growing concern about growth in spending outrunning growth in income. While consumer debt has risen to a record high, it is also true that consumer assets have grown at an even faster pace, so liabilities as a percentage of household assets continues to decline. In addition, the ratio of debt and other recurring payments to income continues at multi-decade lows. At present, consumers’ financial health remains good.

The Atlanta Fed surprised with its GDPNow estimate for real Q2 GDP growth by raising it to 4.8%. It should not be a surprise to anyone when the FOMC raises the fed funds rate by another quarter of one percent next week during its June meeting. There is some speculation the Fed will raise the rate by one-half.

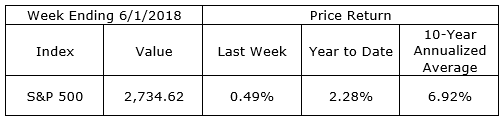

Last Week’s Market

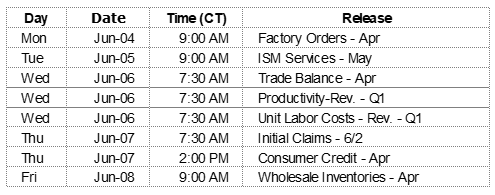

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.