Step #4 begins the process of portfolio allocation. Without going into great detail, the following is a simple overview of the three major asset classes. A review of the historical returns from each asset class along with the corresponding historical business cycles, debt cycles and inflation levels are useful to attempt realistic assumptions of future possible ranges of returns. There are, of course, no guarantees associated with these estimates of future returns and inflation rates, but it is still a useful exercise. At this phase of the process, it is good to realize that with little to no control over future returns, it is necessary to focus on the factors we can control. Calculate the amount of current spending which should be deferred and regularly added to savings and investment accounts in order to achieve future goals.

- Establish financial objectives and determine the time frame associated with each one.

- Determine the amount of savings which will be necessary to fund the investment accounts sufficiently.

- Determine the types of investment accounts available to best take advantage of provisions in the tax code.

- Identify investment classes and determine the realistic expected returns each might generate over the spans of time associated with each objective.

- Cash equivalents or money market accounts and money market funds provide the most safety of principal but low returns. Safety of principal is important over very short time periods but due to inflation cash equivalents are the least safe in terms of safety of purchasing power over time.

- Bonds are loans to governments, government sponsored entities and agencies and corporations. A bond is a contractual obligation with stated rates of interest and maturity dates. The credit worthiness of the issuer (ability to pay interest and return principal upon maturity), the term or length of time over which the loan exists, and the taxability of interest received by the investor will determine the total return to investors.

- Stocks represent ownership in companies. Unlike bonds, there is no contractual obligation between the issuing company and the stockholder, so all returns are potential returns. There are no guarantees. The higher risk should warrant higher returns and historical returns on stock support that theory. There are two sources of return from stocks, dividends and price appreciation. Over long periods of time, the stocks of well financed and well managed corporations have greater chance of protecting the purchasing power of an investment. Stock prices are volatile, however, and represent significant risk of loss to funds invested for short time horizons.

- Identify the risks involved with investing in each of the available asset classes.

- Determine when cash outflows need to begin and from which types of account it should be withdrawn.

On The One Hand

- The ISM non-manufacturing index rose to 58.6 in May, easily beating the consensus expected 57.6. Any reading above 50 is a signal of expansion.

- The trade deficit narrowed in April to $46.2 billion, the result of a $0.6 billion increase in exports and a decline of $0.4 billion in imports from March.

- Weekly initial unemployment claims decreased by 1,000 to 222,000. Continuing claims increased by 21,000 to 1.741 million. The four-week moving average for continuing claims decreased by 13,250 to 1,728,750, which is the lowest level since December 8, 1973. Initial claims have held below 300,000 for 170 straight weeks.

- Total outstanding consumer credit increased by $9.2 billion in April. The increase was the lowest since last September which may suggest consumer demand for credit is slowing.

- Sales growth outpaced inventory growth in the wholesale sector. Wholesale inventories increased 0.1% in April following a downwardly revised 0.2% increase in March. Wholesale sales increased 0.8% in April after increasing an upwardly revised 0.4% in March.

On The Other Hand

- Factory orders were down 0.8% in April after a revised increase of 1.7% increase in March. Behind the headline, orders, excluding transportation, rose 0.4% on top of the previous month’s increase of 0.5%.

- First quarter productivity was revised down to 0.4% from the previously reported 0.7%. Unit labor costs were revised up to 2.9% from 2.7%.

All Else Being Equal

The Atlanta Fed’s GDPNow estimate for real Q2 GDP growth was revised slightly lower to 4.6%. but remained well above by raising it to 4.8%. The New York Fed Staff Nowcast stands at 3.1% for Q2 and projects at 2.9% real growth for the third quarter.

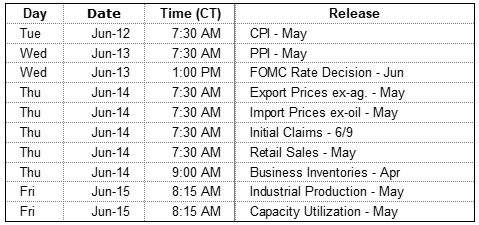

The only question about Wednesday’s rate decision by the Fed is the magnitude. We expect the Fed to raise its Fed Funds target range by one-quarter of one percent to 1.75% to 2.00% but it would not be surprising if it raised by a full one-half of one percent.

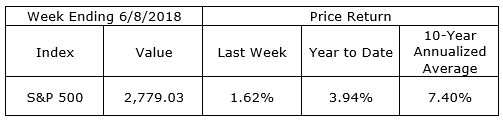

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.