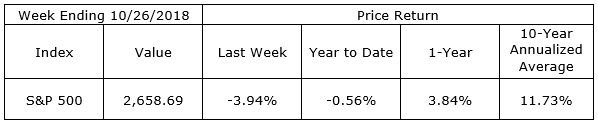

The S&P 500 finished the week down 3.94%, settling at 2,658.69. The index is 9.28% below the September 20th all-time high. The correction may well continue with the next test, an additional 3% lower to 2,581.00, its low close on February 8th at the bottom of this year’s earlier correction.

Interest rates have done little during the weeks of the recent correction. The 2-year and 10-year Treasury yields are 2.80% and 3.18%, respectively, exactly where they were at the market high on September 20th.

On the One Hand

- New orders for durable goods rose 0.8% in September and including revisions to prior months, new orders are up 1.0%. A large increase in defense aircraft orders was behind the gain. Orders are up 7.9% from a year ago.

- Pending home sales rose 0.5% in September following a 1.9% decline in August.

- Initial unemployment claims rose by 5,000 to 215,000 and the four-week moving average was unchanged at 211,750. Continuing claims declined by 5,000 to 1.636 million.

- Real GDP grew at a 3.5% annual rate in the third quarter and is up 3.0% for the year. The price deflator came in at 1.7%

On the Other Hand

- New home sales continued to disappoint by dropping 5.5% in September, an annual rate of just 553,000 units and the slowest pace in almost two years. Revisions to prior months’ sales make September the fourth consecutive month of declining sales. Yet, comparing sales for the first nine months of 2018 with the same period in 2017, sales are up 3.4%.

- The Richmond Fed index, which measures mid-Atlantic factory sentiment, fell to a still elevated 15 in October after hitting 29 in September, its highest level on record (dating back to 1993). First Trust Advisors

- The University of Michigan Consumer Sentiment Index was 98.6, down from the preliminary reading of 99.0 and the final September level of 100.1.

All Else Being Equal

The first Q3 real GDP report put the growth rate at 3.5%. The Atlanta Fed expects Q3 GDP growth to be revised slightly higher to a 3.6% growth rate. Looking to the current year’s fourth quarter and beyond into 2019, expansion continues to be the most likely course for the economy.

Reports indicating the Fed is on a path of action which will bring the expansion to an end by raising interest rates too high, too fast are premature. The Fed’s Beige Book reports, “Economic activity expanded across the United States, with the majority of Federal Reserve Districts reporting modest to moderate growth” and “Prices continued to rise, growing at a modest to moderate pace in all Districts.” Given statements like these, why would anyone think the Fed is likely to increase interest rates at anything greater than a “modest to moderate” pace? The U.S. economy is not so fragile as to buckle under such interest rate increases.

Last Week’s Market

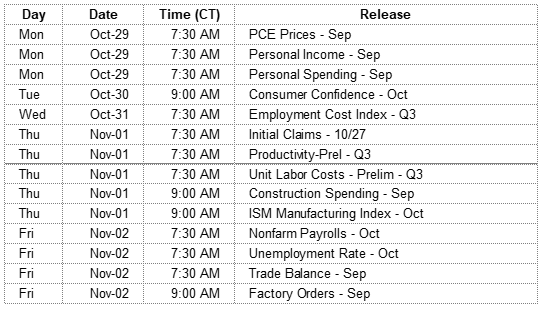

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.