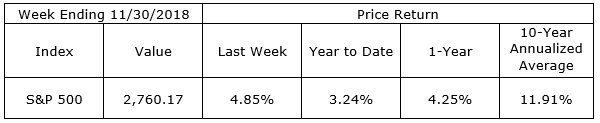

The stock market correction stalled last week. One of two headwinds was eliminated when Fed Chairman, Jerome Powell, confirmed the members of the Federal Open Market Committee are not the ill-informed, mindless and stubborn group many self-serving market participants and commentators had declared them to be in recent weeks. The market gained 4.85%, as measured by the S&P 500, last week.

The second economic headwind fueling the decline in prices since late September has been the concern trade disputes and increasing tariffs would escalate into all-out trade war. Market mavens placed a good deal of emphasis on the outcome of the G20 summit and the Saturday evening meeting between Presidents Trump and Xi-Jinping. No formal statements have been released but comments have been positive enough that stock index futures are signaling higher stock prices Monday morning.

Neither of the two previously mentioned headwinds indicated a long-term change in course for investors. We continue to believe a Fed engineered recession and/or trade wars are low probability events at the present time. Portfolios across all investment objectives are positioned for continued growth in the economic cycle through most of 2019. Double digit percentage gains are not likely but financially sound, well managed equities should outperform fixed income investments over the time horizons of the vast majority of clients.

On the One Hand

- The November Consumer Confidence Index posted its second highest reading since September 2000 as it dipped slightly to 135.7 from the 137.9 October reading.

- Real GDP grew at a 3.5% annual growth rate in Q3, matching the initial estimate.

- Personal income rose 0.5% in October and is up 4.3% in the past year. Personal consumption increased 0.6% in October and is up 5.0% in the past year. Inflation remained moderate as the PCE deflator rose 0.2% in October and is up just 2.0% in the past year.

- Initial jobless claims moved in the wrong direction this week but rose from a historically low level by 10,000 to 234,000. The four-week moving average for initial claims rose 4,750 to 223,250. Continuing claims rose 50,000 to 1.71 million.

- The Chicago PMI rose to 66.4 in November from 58.4 in October. The November index reading moved to an 11-month high, driven primarily by a large increase in the Now Orders component of the index which jumped to 72.5 from 57.9.

On the Other Hand

- New single-family home sales declined sharply by 8.9% in October to a 544,000 annual rate. Sales are down 12.0% from a year ago.

- Pending home sales fell 2.6% in October following their 0.7% increase in September.

All Else Being Equal

Brian Wesbury, Chief Economist at First Trust updated his model with the latest Q3 earnings data and noted:

“Pre-tax corporate profits rose 3.4% in the third quarter – the fastest quarterly growth rate since Q2 2014 – and are up 10.3% in the past year, the largest four-quarter increase since mid-2012 (and thanks to the tax cuts, after-tax profits are up nearly 20% in the past year). Plugging this data into our capitalized profits model puts our estimate of “fair value” for the S&P 500 at 3,614, or roughly 35% above yesterday’s closing value. Even if the 10-year Treasury yield (the denominator in our model) rose to 3.5% today, the market would still be undervalued by nearly 20%. In other words, the correction we have seen since mid-September is emotional, not logical, and we expect markets to move higher in the months ahead.”

Last Week’s Market

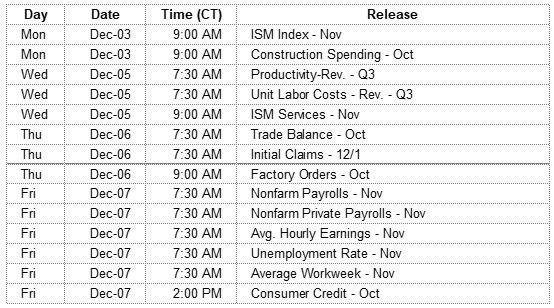

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.