While volatility and the possibility of a test of the recent lows are likely during the first quarter, the 2019 outlook is better than the markets seemed to be signaling in December. There is no sense in me trying to restate what Philip Orlando, CFA and Senior Vice President, Chief Equity Market Strategist and Head of Client Portfolio Management at Federated Investors ($380 billion under management) has to say about the recent past and outlook for 2019.

While the labor market and consumer spending are strong, autos and housing remain in the doldrums, manufacturing trends have stumbled recently and many of the business and consumer confidence metrics we monitor have fallen sharply over the past few months. There are numerous reasons for this, such as the market’s overblown fear of recession, rising interest rates and confusion surrounding the Federal Reserve’s monetary policy plans, and the ongoing trade and tariff skirmish with China. In addition, the lengthening government shutdown, volatile oil prices and concerns about geopolitical risk—with Brexit at the top of the list—are contributing to investor angst.

The S&P 500 plummeted 20% from Sept. 21 to an oversold Christmas Eve trough at 2,346 to price in these concerns, but stocks have enjoyed a powerful 14% V-bottom recovery ever since. Surging stock prices have shattered the critical 2,600 resistance level in the process, and the perma-bears are now scrambling to cover their shorts. At the same time, benchmark 10-year Treasury yields have risen from an overbought 12-month low of 2.55% in early January to 2.77% today, and the volatility index (VIX) has halved itself from an overbought 36 at Christmas to 17 today.

So, while stocks have recovered 70% of their stunning fourth-quarter collapse over the last month, heightened volatility likely will continue through the first quarter, until we receive some clarity on several of these key investor concerns. Ultimately, we expect a positive outcome on the trade deal with China and the Fed’s monetary policy path, which should drive the S&P up to our 3,100 target by year-end 2019.

On the One Hand

- The Producer Price Index declined 0.2% in December leaving producer prices up 2.5% versus a year ago.

- Import prices declined 1.0% in December, placing the annual rate of import price decline at 0.6%. Export prices fell 0.6% for the month and were up 1.1% for the year.

- Weekly initial unemployment claims dropped by 3,000 to 213,000. The four-week moving average for initial claims declined 1,000 to 220,750. Continuing claims increased by 18,000 to 1.737 million.

- Industrial production rose 0.3% in December following a downwardly revised November increase of 0.4% from its original report of 0.6%. Industrial production for the year was up 3.9%. Overall capacity utilization rose 0.1% to 78.7% in December. Manufacturing capacity utilization rose 0.7% to 76.5% in the month.

On the Other Hand

- The preliminary University of Michigan Index of Consumer Sentiment for January dropped from 98.3 in December to 90.7 in January, the lowest level for the index since October 2016.

All Else Being Equal

The partial shutdown in D.C. will delay some reporting from the government. The Atlanta Fed continues its GDPNow estimate, however, and is holding firm with its expectation for a real growth rate of 2.8% for the fourth quarter of 2018.

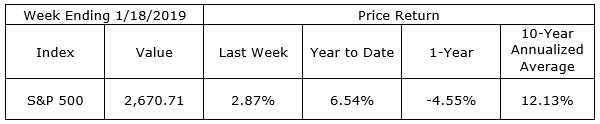

Last Week’s Market

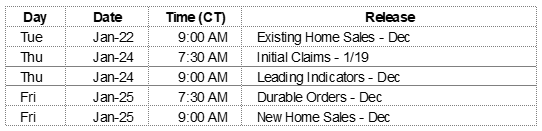

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.