Stocks have recovered nicely from their fourth quarter rout. The Dow Jones Industrial Average was up for the ninth week in a row, the longest winning streak in over twenty years. The S&P 500 was up eight of those nine weeks and now stands less than 5% from its all time high on September 20th.

Much of the equity market recovery is because fear of Fed tightening has subsided. The 10-Year Treasury note yield never rose much above 3.20% last autumn and has recently settled around 2.65%. Slowing global economic growth along with accommodative central bank policies should keep fears of sharply rising interest rates from resurfacing in the very near future.

On the One Hand

- Durable goods orders rose 1.2% in December following an upwardly revised 1.0% increase in November. Excluding transportation, orders increased just 0.1% following a revised 0.2% in November.

- Initial claims declined 23,000 to 216,000. The four-week moving average for initial claims increased by 4,000 to 235,750. Continuing claims declined 55,000 to 1.780 million.

On the Other Hand

- The Philly Fed Index fell to -4.1 in February from +17.0 in January, the first time the index has been in negative territory in nearly three years. The drop was led by declines in both new orders and shipments. On a positive note, the forward expectations index was unchanged at a healthy 31.3, suggesting respondents see the current weakness as temporary.

- Existing home sales declined 1.2% in January to a 4.94 million annual rate. Sales are down 8.5% versus a year ago.

- The Conference Board’s Leading Economic Indicators Index declined 0.1% in January following a flat reading in December. The Coincident Indicator rose 0.1% after increasing 0.2% in December. The Lagging Index increased 0.5% following a 0.3% in December.

All Else Being Equal

Fed Chair Jerome Powell will testify before Congress on economic outlook and Fed policy this week. He will begin with the Senate on Tuesday and finish with the House on Wednesday. This testimony will be followed by the release of the first Q4 GDP release on Thursday.

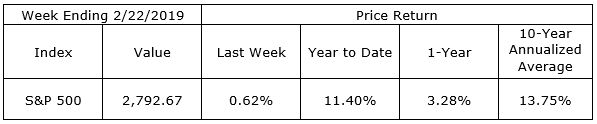

Last Week’s Market

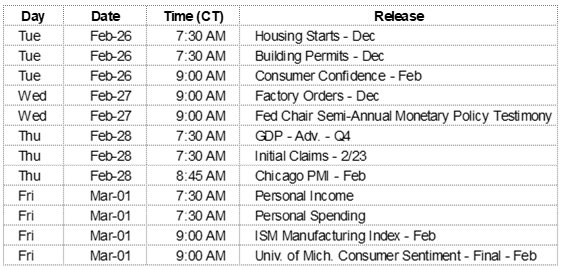

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.