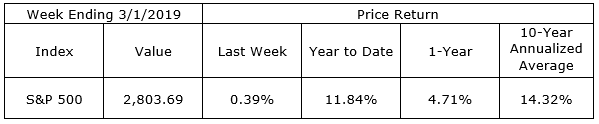

The S&P 500 finished the week 0.39% higher, its fifth up-week in a row and it is the ninth up-week out of the last ten. The month of February finished 2.97% higher following January’s 7.87% gain. After a string of such gains, even the bulls are expecting a pullback to, as the traders say, consolidate these gains. None of this short-termism matters in our financial and estate plans, however, so we will continue to focus on the issues over which we do have some control. Two recent posts on the TCK website address some of these other areas of focus.

Age is a factor which necessarily plays a role in our planning. For instance, years of age referenced in statutes cannot be ignored. The age of majority and the age at which required distributions from retirement plans must begin are two examples. But in the natural search for planning shortcuts, some look to years of age in various rules of thumb or other planning milestones and these are frequently not appropriate. Dr. David Ross addresses the inappropriate use of chronological dates in his thoughtful piece, Time For the Talk.

Another age related decision is addressed in the article by Terry Richards, Retirement Readiness. In her article, she mentions factors to be considered in addition to the Social Security Administration’s definition of full retirement age.

On the One Hand

- The Conference Board’s Consumer Confidence Index rose to 131.4 in February following an upwardly revised 121.7 in January. The February increase ended a string of three monthly declines in a row.

- Factory orders increased 0.1% in December following an upwardly revised 0.5% decline in November. This was the first increase in orders for manufactured goods since September.

- The initial Q4 GDP estimate showed economic output increased at a real annual rate of 2.6%. The GDP Deflator increased 1.8%. Real GDP grew 2.9% in 2018 versus 2.2% in 2017.

- Initial unemployment claims rose 8,000 to 225,000 and the four-week moving average declined 7,000 to 229,000. Continuing claims rose by 79,000 to 1.805 million.

- The Chicago Purchasing Managers Index, rose to 64.7 in February from 56.7 in January.

- Personal income increased 1.0% in December and dipped 0.1% in January. Personal spending declined 0.5% in December. The personal savings rate rose sharply in December to 7.6% from 6.1% in November. The PCE Price Index for December was up 0.1% for the month and up 1.7% year-over-year.

- The final University of Michigan Index of Consumer Sentiment for February was 93.8 up from the January final reading of 91.2.

On the Other Hand

- Housing starts declined 11.2% in December to a 1.078 million annual rate, the slowest pace of activity in two years. Starts are down 10.9% versus a year ago. In the past year, single-family starts are down 10.5% while multi-unit starts are down 11.8%. New building permits rose 0.3% in December to a 1.326 million annual rate. Compared to a year ago, permits for single-family units are down 5.5% while permits for multi-family homes are up 12.2%.

- The ISM Manufacturing Index declined to 54.2 in February from January’s 56.6.

All Else Being Equal

Fed Chair Jerome Powell’s testimony confirmed the Fed is explicitly data-dependent, which means the consistently low consumer price reports and disappointing economic readings will keep a lid on tightening until those factors begin to reverse.

The reports from the Census Bureau, housing starts, retail sales and durable goods, delayed by the government shutdown have all come in below consensus expectations. These reports have also been inconsistent with other figures, job market, purchasing managers and sales figures from Amazon and Walmart. The resulting confusion may keep a lid on optimism until further economic data becomes available over the next several months.

Based on population growth and scrappage, the US needs about 1.5 million new housing units per year but it has not built at this pace since 2006. We have some catching up to do. The dull housing market is not likely to pull the rest of the economy down but is more likely to add to the expansion in coming months.

Last Week’s Market

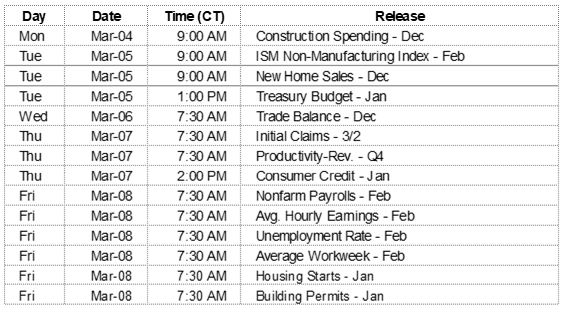

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.