A good first step in the process of evaluating a financial advisor is to determine what is at the center of the advisor’s approach. Become skeptical, if the advice you receive begins to revolve around products as the solutions to your achieving your goals. Processes, rather than products, should be the primary approach of a good advisor. Estate planning, financial planning, investment planning and tax planning goals are solved by sound processes which design, execute and monitor progress toward your goals.

A Certified Trust and Financial Advisor (CTFA) is trained in such processes. Martha Linsner expands on the distinctions between product sales and process development in her article on Certified Trust and Financial Advisors.

On the One Hand

- Weekly initial unemployment claims declined 5,000 to 211,000. The four-week moving average declined 3,250 to 217,250. Continuing claims rose 13,000 to 1.756 million.

- The fourth quarter 2018 GDP Price Deflator was revised downward to 1.7% from 1.8%.

- Personal income rose 0.2% in February. The partial government shutdown delayed February spending data but personal spending in January increased 0.1%. While positive, spending growth was below expectations.

- For January, the Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred price gauge, decreased 0.1% and was up just 1.4% year over year.

- New home sales increased 4.9% in February to a seasonally adjusted annual rate of 667,000. Year over year, new home sales were up 0.6%.

- The University of Michigan Index of Consumer Sentiment for March increased to 98.4 from its preliminary reading of 97.8.

On the Other Hand

- Housing starts fell 8.7% month over month in February to a seasonally adjusted annual rate of 1.162 million units. Compared to February 2018, starts were down 9.9%. Building permits were down 1.6% in February compared to January and down 2.0% year over year.

- The Conference Board’s Consumer Confidence Index dropped sharply to 124.1 in March from 131.4 in February, the index’s fifth decline in six months.

- The third estimate for fourth quarter 2018 GDP was revised downward to 2.2% from 2.6%. Even after the slight downward adjustment, real growth from 12/31/2017 to 12/31/2018 remained good, coming in at 2.9%.

- The Chicago Purchasing Managers Index dropped to 58.7 in March from 64.7 in February. The index remains in expansion territory, above 50.0.

All Else Being Equal

The data shows the economy continues to expand but it also clearly indicates momentum is slowing. The week’s reports also confirm consumer price increases, inflation, are well under the Fed’s target. The Fed’s prior rate increases, as well as the effects of trade policies at home and in the EU (Brexit), have had their impact. The limp housing market and lackluster business investment continue to be drags. The U.S. jobs market remains a bright spot.

The Atlanta Fed staff GDPNow estimate for Q1 real growth is up to 1.7%.

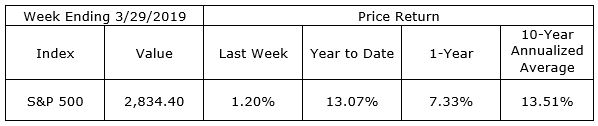

Last Week’s Market

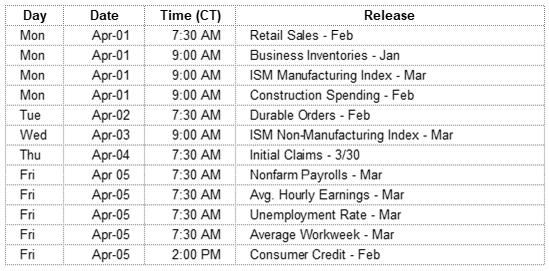

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.