Economic data became more volatile in the final months of last year and the early months of 2019. Some unexpected softness in retail sales and a leveling off of consumer optimism added to the ongoing sluggishness in home sales and business capital investment. The Fed had raised short term rates as the economy grew through early 2018 and the stock market dropped nearly 20% in 65 trading days between September 20th and December 24th. Headline writers avoided the most likely but dull middle ground and went directly to recession talk.

As it has said all along, the Fed has proven to be data dependent. It has not continued to raise rates but has instead chosen the dull middle ground of stable rates at present. The stock market appears to have gained its footing and then some by gaining 23% from its Christmas Eve low. The economy continues to expand, although at a somewhat slower pace, driven by solid job growth with no inflation pressure.

Going forward, the mood will begin to be shaped by quarterly earnings reports set to begin rolling out in the coming weeks. View the upcoming headlines with caution. To help you measure the reports against the currently reasonable expectations, consider the excellent description of the dull, middle ground prospects for Q1 earnings provided by Linda Duessel, Senior Equity Strategist at Federated Investors, Inc., and do not let the headlines change your strategy.

Earnings are expected to contract, with bottom-up 2019 estimates resting at about $168, having fallen steadily since the beginning of the year. S&P 500 revenue and earnings growth peaked in mid-2018 and, based on current estimates, likely bottomed in the just-completed quarter. Year-over-year (y/y) revenue growth is set to slow to 3.9% from 6% previously, with earnings projected to shrink across 10 of 11 sectors. But, the pace of downward earnings estimate revisions for the next 12 months (NTM) has been moderating, so much so that the constant maturity NTM estimate hit a low in mid-February and has been working higher since. Combined with evidence the economy—while slowing—is still growing, the underpinnings of stronger-than-expected results may be in the offing for the second and third quarters.

On the One Hand

- The ISM Manufacturing Index rose to 55.3 in March from the February post of 54.2.

- Construction spending, beating expectations, increased 1.0% in February on the heels of an upwardly revised 2.5% increase (from 1.3%) in January.

- Weekly initial unemployment claims continued to surprise with a decline of 10,000 putting new claims near a historic low of 202,000 and the four week average at 213,500, a decline of 4,000 from the previous week. Continuing claims fell by 38,000 to 1.717 million.

- March nonfarm payrolls increased by 196,000. The March unemployment rate was 3.8%. Average hourly earnings were up 0.1% in the month and up 3.2% over the last 12 months. The average workweek was 34.5 hours compared to last month’s 34.4 hours. The labor force participation rate was 63.0% in March down slightly from February’s 63.2%.

On the Other Hand

- Retail sales declined 0.2% in February, however, the negative headline was more than offset by an upward revision in January’s gain from 0.2% to 0.7%.

- Durable goods orders declined 1.6% in February.

- The ISM Non-Manufacturing Index declined to 56.1% in March from the previous month’s reading of 59.7%. While the services index has dipped to its lowest level since December 2018, it does remain above 50.0% which means it continues to signal expansion rather than contraction.

All Else Being Equal

The Atlanta Fed staff GDPNow estimate for Q1 real growth moved higher to 2.1%.

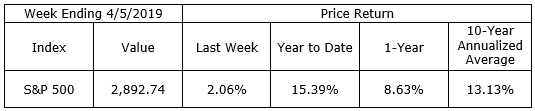

Last Week’s Market

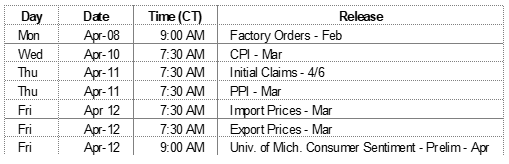

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.