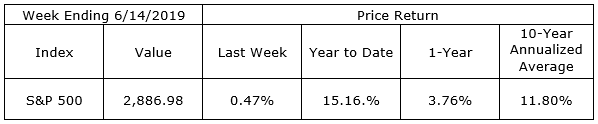

Little has happened in the two weeks I was away. Conflicting messages on the economy continued but our stuttering expansion continued. The stock market, while volatile on a daily basis, finished the past 2-week period with a correction of just 0.93%. The bond market left us with slightly lower yields over the period with the 2-year Note finishing last week with a yield of 1.84%, the 10-year Note at 2.09% and the spread widening a bit to 0.25%.

On the One Hand

- Producer prices as measured by the PPI rose 0.1% in May, putting the year over year rate of increase at 1.8%.

- Consumer prices (CPI) in the month of May were up 0.1%, leaving the annual rate of price increases at 1.8%.

- Weekly initial unemployment claims were 222,000 and the four-week moving average stands at 217,750. Continuing claims stand at 1.695 million.

- Retail sales increased 0.5% in May and April sales were revised upward by 0.5%, to a 0.3% increase from the originally reported decline of 0.2%.

- Industrial production increased 0.4% in May and April production was revised upward by 0.1% to a decrease of 0.4%. Total capacity utilization increased to 78.1% from April’s unrevised 77.9%.

On the Other Hand

- The preliminary June reading for the University of Michigan Index of Consumer Sentiment dipped to 97.9 from May’s final reading of 100.0.

- Business inventories increased 0.5% in April following the flat reading in March. Business sales dipped 0.2% following the 1.3% growth in March. Inventory growth for the year was 5.3% and sales growth stood at just 2.8%.

All Else Being Equal

Overall growth continues at its sluggish pace supported by a good jobs market and low consumer price increases.

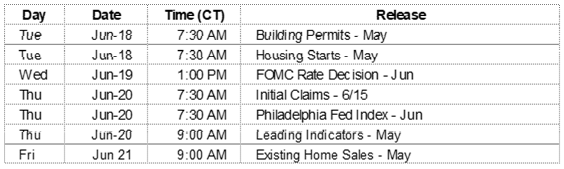

Two significant sources of new information could come in the last half of this month. The focus this week will be on the Federal Reserve’s Open Markets Committee which will meet this week to determine its current fed funds rate level and signal future expectations. A greater potential for market moving announcements will come during and after the G20 meeting on June 28th and 29th with hopes for a resumption of serious trade negotiations between China and the United States.

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.