The cost of capital has been declining around the world. Interest rates are at or below zero in many countries. Nominal interest rates in the U.S. remain positive but our real interest rates (yield minus the rate of inflation) are at or below zero. The 10-Year Treasury, after a run up to over 3.20% last October, now stands at 1.67%. The CPI will be updated tomorrow but last month’s report put the rise in consumer prices over the year ending in June at 1.60%. This puts the real yield on a 10-Year Treasury Note at a minuscule 0.07%. The 2-Year Treasury yield has declined to 1.58% and is now generating a real negative yield of 0.2% (1.58% minus 1.60% inflation).

This leaves savers coming up short as money market accounts and certificate of deposit balances continue to grow at rates which will not keep up with the cost of a basket of goods and services. It is worse when you consider the income taxes which reduce savers’ returns even more. The flip side is borrowers are in a great environment. Home buyers can benefit greatly from very low mortgage rates. The extremely low cost of capital places credit worthy businesses in a position to invest in new technology and infrastructure with the reduced risk which results from low interest expense.

Investors have gotten skittish after the recent recovery of stock prices to new record highs. The recent trend cannot continue indefinitely. The economic slowdown and even recession in economies around the world, the escalating roadblocks to free trade, political turmoil around the globe, and now historically low interest rates have raised levels of anxiety. Do not be surprised if the current correction extends through the balance of summer and into fall.

On the One Hand

- The U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Statistics (JOLTS) report stated the number of job openings on the last business day of June was little changed at 7.3 million. Over the month, hires and separations were little changed at 5.7 million and 5.5 million, respectively. Within separations, the quits rate was unchanged at 2.3% and the layoffs and discharges rate was little changed at 1.1%.

- Initial jobless claims fell by 8,000 to 209,000, setting the four-week moving average for initial claims at 212,500. Continuing claims for the week were lower by 15,000 to 1.684 million.

- Consumer credit increased by $14.6 billion in June compared to the May increase of $17.8 billion.

- The Producer Price Index (PPI) rose 0.2% in July, in line with expectations. Prices for goods were up 0.4% while prices for services were down 0.1%. Year-over-year producer prices were up 1.7% and under the Fed’s 2.0% target.

On the Other Hand

The rate of growth in the service sector continued to decelerate in July. The ISM Non-Manufacturing Index fell to 53.7% in July from 55.1% in June but did remain in expansion territory.

All Else Being Equal

Near the midway point, the Atlanta Fed staff’s GDPNow estimate for Q3 real GDP growth stands at 1.9%. The New York Fed Staff Nowcast stands at 1.6% for the same period.

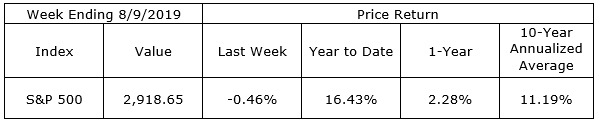

Last Week’s Market

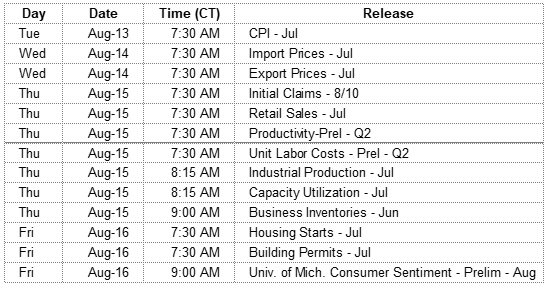

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.