It is time again to start thinking about tax planning for the current tax year. Many financial decisions made during the year have already included a consideration of the impact on tax liability. Late summer is the best time to step back from the trees of the many on-the-fly calculations made throughout the year and consider the forest, your plan for the full tax year and into the next.

If gifting is part of your plan, the annual exclusion for 2019 is the same as last year, $15,000 per recipient. A husband and wife can each give $15,000 to an individual for a total gift of $30,000 per recipient. Gifts in excess of the annual exclusion amount in any calendar year are required to be reported on a gift tax return.

The Qualified Charitable Distribution (QCD) continues to be an underused method of charitable giving. Payments to the charities you support can be made directly from your IRA to those organizations. There are limitations. Under current law, the donor/IRA owner must be age 70-1/2 or older when the distribution is made and total QCD distributions in any year are limited to $100,000. Donations made as QCDs can be used to satisfy the IRA owner’s required minimum distribution. An additional benefit, the amounts paid to charities using QCDs are not deducted from income as itemized tax deductions but rather are not reported as income in the first place. Users of QCDs can therefore derive additional tax benefits by having their Adjusted Gross Incomes reduced by the amount of such donations.

These are just a few ideas to get you started and now is the time to begin thinking about such transactions. Do not wait until the final weeks of the year to begin. The additional time and documentation necessary to meet the requirements for a QCD may not be possible if you wait until the last few days of the year.

If you are into trust tax issues, Angela Malley’s piece, Spotlight on Trust Taxes, is but one example of the sort of tax planning issues which may need to be considered in the development of an efficient estate plan. For more in depth information on personal or trust tax strategies, contact Angela or any of the other officers at The Trust Company of Kansas.

On the One Hand

- The Consumer Price Index (CPI) increased 0.3% in July, in line with expectations. The CPI was up 1.8% year-over-year.

- Import prices rose 0.2% in July and export prices followed suit rising 0.2%. Year-over-year import prices declined 1.8% compared to an increase of 4.8% in the year ending July 2018. Export prices were also lower in the year ending in July, down 0.9% compared to the previous year’s increase of 4.3% for the 12 months ending in July 2018.

- Initial unemployment claims remained well under 300,000 after the week’s 9,000 claim increase to 220,000, setting the four-week average at 214,000. On the other hand, continuing claims rose sharply by 39,000 to 1.726 million and above the four-week moving average of 1,697,250.

- Retail sales increased 0.7% in July, beating the consensus expected gain of 0.3%. Retail sales are up 3.4% versus a year ago.

- The preliminary report on nonfarm business sector productivity showed an increase of 2.3% in the second quarter. While less than Q1’s 3.5% growth, productivity was still a healthy print and an improvement from the Q2 2018 reading of 1.8%. Productivity continues to show improvement relative to the 1.3% annual averages for both 2018 and 2017. Unit labor costs rose 2.4% in the second quarter and Q1 was revised upward to 5.5%.

On the Other Hand

- Industrial production was weak in July, declining 0.2% for the month and reducing the year-over-year rate of growth to just 0.5%. Manufacturing, which excludes mining/utilities, fell 0.4% in July and is down 1.5% year-to-date.

- The total industry capacity utilization rate fell to 77.5% from a revised 77.8% in June. Manufacturing capacity utilization fell to 75.4% in July from 75.8% in June.

- Total housing starts declined 4.0% in July, to a seasonally adjusted annual rate of 1.191 million units. Single family starts did show a bit of growth, rising 1.3% month-over-month to 876,000. Total building permits rose 8.4% for the month but were primarily by an increase in permits for dwellings with five or more units. Single-family permits were up just 1.8% to 838,000.

- The preliminary University of Michigan Consumer Sentiment report for August came in at 92.1, down from the final July reading of 98.4.

All Else Being Equal

All of the recent renewed talk of inversions and recession did not influence the Atlanta Fed’s staff this week. It’s GDPNow estimate for current quarter real growth has been raised to 2.2%.

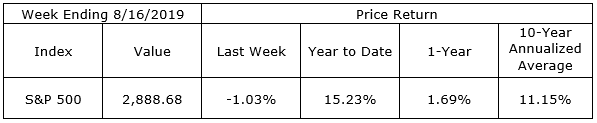

Last Week’s Market

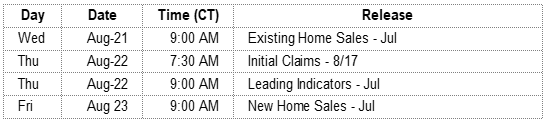

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.