Angela Malley returns this week with more tax-focused thoughts in, How to Avoid Early Withdrawal Penalties, available on our web site. The tax code includes some well-intended tax penalties for certain withdrawals from an Individual Retirement Account (IRA). The penalty is meant to encourage workers to postpone tapping into such balances until retirement or at least until after the account owner turns age 59-1/2. Life can, however, present one with situations in which an early withdrawal from an IRA may be necessary. Fortunately, Congress has recognized some of those situations as worthy of a waiver of the IRS penalty (but not the tax). The linked article is a good summary of such situations. If you have questions about your specific situation, contact Angela or your account administrator for personal guidance.

On the One Hand

- U.S. trade figures showed little change in July. The trade deficit narrowed to -$54.0 billion from June’s -$55.5 billion. Total trade increased by $800 million to $468.8 billion. Year-over-year, total U.S. foreign trade is down just $1.1 billion or one quarter of one percent.

- Initial unemployment claims for the week increased by 1,000 to 217,000 putting the four-week moving average for initial claims at 216,250, up 1,500 from last week’s report. Continuing claims for the week dropped by 39,000 to 1.662 million.

- Factory orders rose 1.4% in July following a downwardly revised 0.5% increase (from 0.6%) in June.

- The ISM Non-Manufacturing (Services) Index rose to 56.4% in August from the 53.7% print in July.

On the Other Hand

- While construction spending increased 0.1% in July and the June figure was revised upward by 0.6% to a monthly decline of 0.7%, the data now puts total construction spending at a 2.7% year-over-year decline, the ninth straight year of decline.

- The ISM Manufacturing Index for August dipped out of expansion territory to 49.1%, down from the 51.2% reading for July.

- Second quarter productivity was unrevised at 2.3% while unit labor costs were revised upward by 0.2% to 2.6%.

- August nonfarm payrolls and revisions disappointed by rising 130,000, about 40,000 less than the consensus expectation. July nonfarm payrolls were revised downward to 159,000 from 164,000 and June payrolls were revised downward to 178,000 from 193,000. Job gains over the past 3 months have averaged 156,000. The report was not entirely disappointing. The unemployment rate remained unchanged at 3.7%. Average hourly earnings were up 0.4% month-over-month and 3.2% year-over-year. The average workweek rose slightly to 34.4 hours from 34.3. The average manufacturing workweek increased 0.2 hours to 40.6 hours. The labor force participation rate grew to 63.2% in August versus 63.0% in July.

All Else Being Equal

While growth rates are softening, recession in the U.S. appears to be a long way off. The Atlanta Fed’s staff calculates its GDPNow estimate for growth in the current quarter to be 1.5%. The New York Fed staff’s Nowcast for real GDP growth is also estimated at 1.5% in the current quarter and 1.1% in Q4.

The FOMC meets next week and current market interest rates signal the expectation of at least a one-quarter percent fed funds rate cut and as much as one-half. Investors will be tuned into Jerome Powell’s announcement a week from Wednesday.

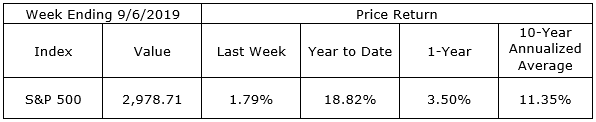

Last Week’s Market

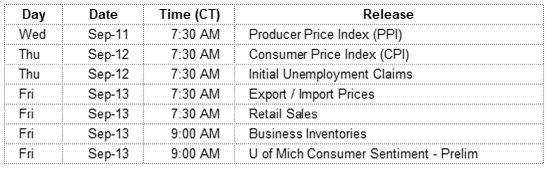

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.