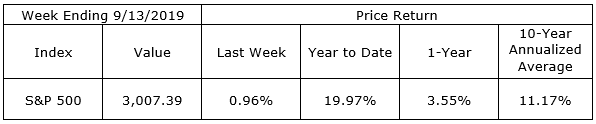

Stocks rebounded from their summer correction which, to date bottomed in mid-August after a decline of around 6% (fall officially begins on September 23rd). The S&P 500 was up nearly one percent for the week, finishing about one-half percent under its all-time high of 3,025.86.

The real action lately has been in the normally sleepy fixed income markets. The 10-year Treasury yield over the last nine trading days has risen from a low of 1.46% to 1.90%. When interest rates rise, the prices of existing bonds decline. In this recent rate rise, some 10-year bond holders have seen the prices of their bonds decline 4% or more.

Over the weekend, news of the Saudi oil facility sabotage and the resulting reduction of the world’s oil supply by 5% underlie the next round of volatility in the markets. Oil prices and the stocks of oil companies will rise, the broader stock market will temporarily decline, bond prices will rise (and rates will decline) briefly as traders attempt to take advantage of the news.

The world economy will adjust and thanks to diversification, we can largely ignore the latest narratives of the pundits. A portfolio which is diversified to support your personal long-term goals will not be so concentrated in any one of asset classes as to prevent long-term portfolio growth. We attempt to take advantage of market turmoil by looking for opportunities which often present themselves during such periods. At the same time, we are always focused on the broader picture. Do not become a victim of short-term thinking. Stay focused on your larger financial and estate plans. Diversify your thinking away from the current market news and prioritize your important goals, one of which should be an efficient estate plan. Sheryl Hammond touches on some of these points in her piece, Everyone Needs a Will.

On the One Hand

- The Producer Price Index (PPI) increased 0.1% in August. The PPI was up 1.8% versus a year ago. Core PPI was up 0.3% for the month and 2.3% in the past year.

- Consumer prices (CPI) rose 0.1% in August and were up 1.7% year-over-year. Core PPI was 0.3% higher in the month and was up 2.4% for the twelve months ending in August.

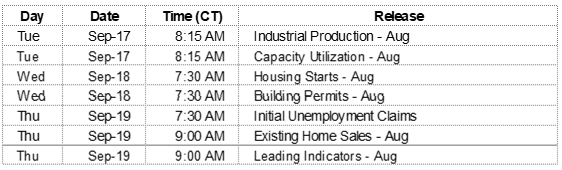

- Weekly initial unemployment claims declined by 15,000 to 204,000, leaving the four-week moving average for initial claims at 212,500, a decline of 4,250. Continuing claims declined by 4,000 to a total of 1.670 million.

- Retail sales increased 0.4% in August and July sales were revised upward to 0.8% from 0.7%. Annual retail sales are up 4.1% versus a year ago. Excluding autos, retail sales were unchanged in August. Sales ex-autos are up 3.5% in the past year.

- Business inventories grew by 0.4% in July after being unchanged in June. Business sales increased 0.3% after also being unchanged in June. Prices should remain in check given the year-over-year inventory growth of 4.8% and sales growth of 1.3%.

- The preliminary reading for the University of Michigan’s Index of Consumer Sentiment rebounded to 92.0 from the August decline to 89.8. The increase still leaves the sentiment indicator 8.1% lower than its year ago level.

On the Other Hand

The temporary loss of 5% of the world’s oil supply will have an impact on consumers as the recent decline in gasoline prices comes to an end. Prices are likely to rise back to summer highs until Saudi production facility repairs have been made.

All Else Being Equal

The Atlanta Fed’s staff has raised its GDPNow estimate for real growth to 1.8% from 1.5%. The New York Fed staff’s Nowcast estimate was raised to 1.6% for the current quarter and remained steady at 1.1% growth in Q4.

The FOMC meets this week and will announce its fed funds rate Wednesday afternoon. Even with the rebound in market rates last week, expectations are for a reduction of one-quarter percent.

Last Week’s Market

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.