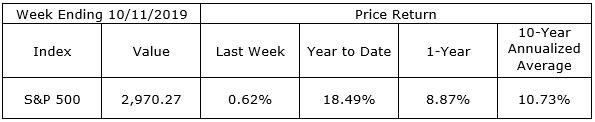

After three weeks of declines, the S&P 500 rose 0.62% last week leaving the index roughly unchanged for the quarter. Weakness early in the week disappeared on Friday as news of a partial agreement in the trade negotiations between the United States and China began to circulate. Details have not been made clear other than withdrawal of the tariffs scheduled to go into effect October 15 and rumors of Chinese purchases of U.S. agriculture products.

U.S. government bond yields also rose last week as some recession fears were replaced with expectations of continued growth but on a lower trajectory. The yield on the 10-Year Treasury finished up twenty-some basis points to finish the week at 1.75%.

Investors will be looking over earnings reports which will begin to steadily flow out this week and next.

On the One Hand

- The Producer Price Index (PPI) declined 0.3% in September. On a year-over-year basis, the PPI was up just 1.4% versus being up 1.8% in August.

- The Consumer Price Index (CPI) was unchanged in September, putting the year-over-year rate of consumer price increases at 1.7%.

- The weekly initial unemployment claims report posted a decline of 10,000 to 210,000 claims. The four-week moving average for initial claims was calculated at 213,750, an increase of 1,000. Continuing claims were up 29,000 to 1.684 million.

- The preliminary University of Michigan Consumer Sentiment Index for October printed at 96.0, up from September’s final reading of 93.2.

- Prices for U.S. imports were up 0.2% in September, after a 0.2% decline in August and remaining unchanged in July. Import prices declined 1.6% in the year ending with September 2019. Export prices declined 0.2% in September following a 0.6% drop in August and a 0.2% advance in July. U.S. export prices fell 1.6% from September 2018 to September 2019.

On the Other Hand

There is nothing to report this week.

All Else Being Equal

The inflation data released this week was benign. There is little evidence of inflationary pressures for the Fed to feel a need to jump in front of them. Although few believe significant business investment is being held up due to the current level of interest rates, most continue to expect another one-quarter of one percent reduction in the Fed Funds rate on October 30.

Last Week’s Market

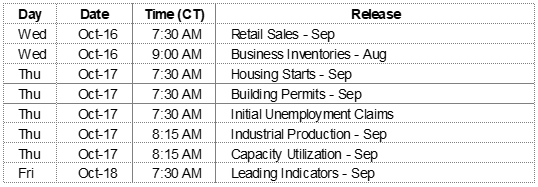

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.