The S&P 500 closed at 3,066.91, the second consecutive weekly new high and a gain of 11.92% from the year-ago level. Treasury yields were lower with the 2-year finishing the week at 1.55%, down 7 basis points. The 10-year yield dipped a similar amount and closed with a yield of 1.73%.

The backdrop has been the generally good third-quarter earnings reports. Roughly 84% of S&P companies have reported earnings that beat expectations. While overall profits are expected to fall about 2.7% from a year earlier, most analysts have called a bottom, noted the Wall Street Journal. “They project earnings growth to accelerate next year, helping to allay fears of a potential recession.”

Those looking for the current economic expansion to die of old age and collapse in recession in 2020 are likely to be surprised. Recessions are necessary to correct excesses that develop during economic expansions. With minor exceptions in a few industries, there are no sectors in today’s U.S. economy that are experiencing excesses that need to be wrung out.

On the One Hand

- Slow growth continues as third-quarter real GDP growth was reported at 1.9% in the advance report, comfortably above expectations and only slightly below the second quarter’s growth rate of 2.0%. On the price front, the GDP Price Deflator was up just 1.7%, down from the 2.4% rate of increase reported in the second quarter.

- For the 243rd week, initial unemployment claims were below 300,000. Claims increased by 5,000 to 218,000. The four-week moving average for initial claims declined by 500 to 214,750. Continuing claims increased by 7,000 to 1.690 million.

- Moderate growth in compensation continued in the third quarter. The Q3 Employment Cost Index rose 0.7% following the 0.6% increase for the three months ending in June 2019.

- Personal income was up 0.3% in September. Personal spending was up 0.2% in the same month.

- The PCE Price Index was unchanged for the month of September and up 1.3% year-over-year.

- October nonfarm payrolls rose by 128,000, which includes the estimated 42,000 jobs which were lost in the auto industry due to the GM strike. Additionally, August and September payrolls were adjusted upward by a total of 95,000 jobs putting average monthly gain over the last three months at 176,000 jobs. The labor participation rate rose slightly to 63.3% from 63.2% which accounted for the increase in the unemployment rate from 3.5% to 3.6%. Average hourly earnings rose 0.2% and the average workweek was flat at 34.4 hours.

- Total construction spending was 0.5% higher in the month of September but was mostly offset by a 0.4% negative revision to the August figure to -0.3%.

On the Other Hand

- Lingering worries were reflected in the Conference Board’s Consumer Confidence Index which receded slightly to 125.9 in October from an upwardly revised 126.3 in September. The most recent level was marginally higher than the initial September point of 125.1.

- Although slightly improved from September’s 47.8% reading, the ISM Manufacturing Index for October remained in contraction territory (below 50) at 48.3%.

All Else Being Equal

Moderate growth with low consumer price increases continues to be the base case for the U.S. economy. The Fed nevertheless saw fit to reduce its fed funds rate by one-quarter of a percent on Wednesday to a range of 1.50% to 1.75%. Going forward, comments from various Fed officials indicate no preconceived notions about the FOMC’s upcoming rate decisions. Members want to observe the path of economic data before making any future rate decisions.

The anticipated slowdown in the extended U.S. economic expansion is evident in the early estimates for Q4 growth. With one month under our belts, the GDPNow model at the Atlanta Fed estimates real GDP growth in the fourth quarter of 2019 will be 1.1 percent. The New York Fed Staff Nowcast stands at just 0.8% for 2019’s fourth quarter.

Last Week’s Market

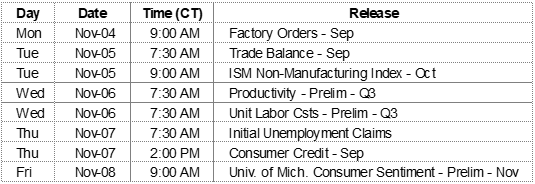

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.