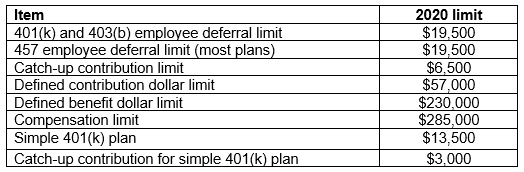

To make it possible for voluntary retirement savings to keep up with inflation, the various numerical limits embedded within qualified retirement plans are indexed for inflation. The IRA contribution limit stays at $6,000 if the individual is younger than age 50 in 2019, and $7,000 if he or she attains age 50 or older in 2020. The limits for 401(k) plans also get a $500 bump up, as shown in the following table:

Catch-up contributions are permitted by those employees who are 50 years of age or older during the calendar year. Personal saving for retirement never has been more important. These tax benefits make saving a bit less painful.

Do you have a question concerning retirement planning? Send your inquiry to Lee Anne Thompson at lthompson@tckansas.com.