On a day to day basis, perceptions, expectations and the anxiety these produce determine the direction of stock prices. These daily emotional swings are ultimately supplanted by the underlying valuations of businesses. The underlying valuations of businesses are based on revenue and earnings.

Bloomberg recently released the 2020 and 2021 consensus growth rate projections for the Standard & Poor’s 500 stock index. In aggregate, revenue is estimated to grow 4.8% in 2020 with earnings up 9.2%. Revenue is expected to grow 4.7% in 2021 with earnings rising 10.5% for the year. Five sectors are expected to generate double digit earnings growth in each of the two years: Communication Services, Energy, Industrials, Information Technology and Materials.

Even if these consensus figures are off the mark, they do signal a generally positive trend for the U.S. economy and aggregate corporate financial performance. The latest job openings report showed 7.3 million jobs were available. The labor participation rate has been growing slowly. Average hourly earnings are growing faster than inflation, putting consumers in good financial health. The Twenties may not be off to a roaring start but they are clearly beginning on a positive note for consumers and investors.

On the One Hand

- Initial unemployment claims declined by 2,000 to 222,000, setting the four-week average at 233,000. Continuing claims rose by 5,000 to 1.728 million.

- Driven by single-family units, total construction spending increased 0.6% in November following an upwardly revised 0.1% increase (from -0.8%) in October.

On the Other Hand

- The stalled momentum of the Conference Board’s Consumer Confidence Index continued with the December report, coming in at 126.5 versus the previous month’s 126.8.

- Manufacturing activity continued to slow as 2019 came to a close. The Institute for Supply Management (ISM) Manufacturing Index hit its lowest level since 2009 coming in at 47.2 in December. The index has been in contraction territory (below 50) since July.

All Else Being Equal

Inflation remains subdued and the Fed will presumably keep interest rates on hold through early 2020. Recent Fed statements indicate the FOMC is no longer concerned about getting out in front of potential higher inflation. On the contrary, it may allow inflation to move above its 2.00% target rate before higher short-term rates will be considered necessary.

The expectations for economic growth remain mixed. The first official report on fourth quarter growth comes out on January 30. Ahead of that, the Atlanta Fed staff’s GDPNow estimate is for real growth of 2.3%. The New York Fed staff’s Nowcast estimate is for growth of less than half that amount at 1.1%.

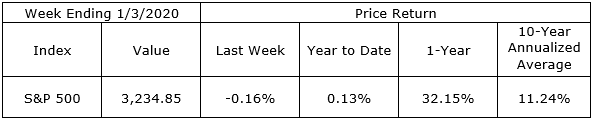

Last Weeks Market

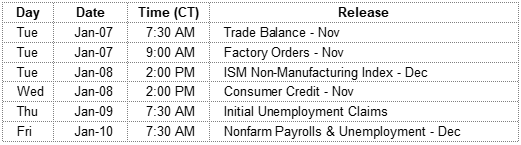

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.