Tech stocks rallied last Monday, and the S&P 500 once again spent some of the day above its record high, only to tail off by the end of trading. The Nasdaq jumped 1.0%, thrust higher by a surge in mega-tech stocks. The Dow fell 0.3%, the S&P 500 gained 0.3%, the Russell 2000 climbed 0.5%, and the Global Dow inched ahead 0.1%. Industrials fell, pulled lower by falling airline, aerospace, and defense stocks. Energy shares also dropped, despite a bump higher in crude oil prices. The dollar and Treasury yields declined by the close of trading last Monday.

The market was another mixed bag of results last Tuesday as the Nasdaq, the S&P 500, and the Global Dow posted modest gains, while the Dow and the Russell 2000 lost value. Treasury yields, crude oil, and the dollar fell, but gold prices rebounded to close the day higher. Mega-stocks and technology led the advance, while cyclical stocks dropped. A strong housing starts report drove the S&P 500 to a record high earlier in the day, but the index fell back as investors sold to capture gains.

Only the small caps of the Russell 2000 finished last Wednesday ahead, as the remaining benchmark indexes listed here fell. The Dow fell 0.3%, the S&P 500 dropped 0.4%, and the Nasdaq tumbled 0.6%. The dollar and Treasury yields rose, while crude oil prices sank.

Despite a spike in weekly jobless claims, stocks rebounded last Thursday. Market sectors fairing well included technology and communications, while financials, materials, industrials, and energy fell. The Dow rose 0.2%, the S&P 500 climbed 0.3%, and the Nasdaq surged 1.1% (reaching a new record). The Russell 2000 and the Global Dow fell 0.5% and 0.8%, respectively. Treasury yields, crude oil prices, and the dollar all lost value.

Last Friday saw tech stocks soar, pushing the Nasdaq to a record high. The Dow and the S&P 500 also advanced, gaining 0.7% and 0.3%, respectively. The Russell 2000 fell for the second consecutive day, dropping 0.8%. Crude oil prices and Treasury yields fell while the dollar rose.

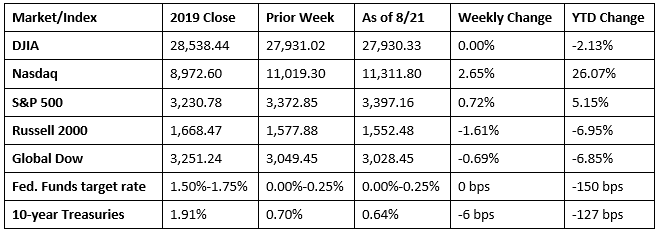

For the week, the Nasdaq advanced 2.7%, followed by the S&P 500, which gained 0.7%. After reaching a record high last Tuesday, the S&P 500 recorded the fastest recovery from a bear market in history, as determined by Barron’s and Dow Jones Market Data. For the week, tech stocks and communication shares performed well, while energy and financials underperformed.

Crude oil prices ended the week at $42.29 per barrel by late Friday afternoon, up from the prior week’s price of $42.18. The price of gold (COMEX) fell for the second consecutive week, closing at $1,946.20, down from the prior week’s price of $1,954.10. The national average retail price for regular gasoline was $2.166 per gallon on August 17, unchanged from the prior week’s price and $0.432 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- July saw housing starts jump by 22.6%, the largest monthly increase since 2016. Housing starts are 23.4% above the July 2019 rate. Single-family housing starts in July were 8.2% above the June total. Building permits also soared in July, climbing 18.8% above the June total and 9.4% higher than the July 2019 mark. Building permits for single-family homes increased by 17.0% in July. Housing completions rose by 3.6% last month and are 1.7% ahead of the July 2019 pace. Single-family home completions increased by 1.8% for the month.

- Existing home sales followed a robust June with a strong July. Total home sales jumped 24.7% over June’s totals, setting a new record for monthly home sales. Total home sales are 8.7% ahead of last year’s pace. Single-family home sales increased 23.9% in July. The median existing home price for all housing types in July was $304,100 ($295,300 in June), up 8.5% from July 2019. The median existing single-family home price was $307,800 in July. Total housing inventory sits at a 3.1-month supply at the current sales pace, down from 3.9 months in June.

- For the week ended August 15, there were 1,106,000 new claims for unemployment insurance, an increase of 135,000 from the previous week’s level, which was revised up by 8,000. According to the Department of Labor, the advance rate for insured unemployment claims was 10.2% for the week ended August 8, a decrease of 0.4 percentage point from the prior week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 8 was 14,844,000, a decrease of 636,000 from the prior week’s level, which was revised down by 6,000.

Eye on the Week Ahead

The last week of the month brings with it some important economic reports. The second estimate of the gross domestic product for the second quarter is available this week. According to the advance estimate, the economy slumped at a rate of nearly 33.0% in the second quarter. July’s report on personal income and outlays should show that consumer income increased last month, as did the cost of consumer goods and services. While inflation is inching upward, it is still well below 2.0%.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.