Last week began with a bang. The Dow climbed 1.4% to reach 28,300 for the first time since February. Investors were encouraged by word that the Trump administration may push the Food and Drug Administration to approve vaccines and treatments for the COVID-19 virus. While the rhetoric may be more bark than bite, it was enough to push market indexes to record highs. The Nasdaq advanced 0.6%, and the S&P 500 rose 1.0%, each reaching all-time highs. The Russell 2000 gained 1.0%, and the Global Dow picked up 1.5%. The dollar, Treasury yields, and crude oil prices all rose. Sectors that enjoyed a strong start to the week were energy, financials, and industrials. Technology and health care also posted modest advances.

Last Tuesday saw stocks advance despite weakening consumer confidence. Word that the United States and China intend to honor their commitment to the phase-one trade deal offered some encouragement for investors. The Nasdaq and the S&P 500 reached new highs, while the Global Dow (0.2%) and the Russell 2000 (0.2%) posted modest gains. Of the indexes listed here, only the Dow lost value. Crude oil prices and the dollar fell, while Treasury prices dropped, pushing yields higher.

Stocks continued to reach record highs last Wednesday on the expectations that the Federal Reserve will continue its supportive monetary policy and keep interest rates low. A strong durable goods report also helped boost investor confidence. Mega-cap stocks and technology shares drove the market higher. The dollar weakened; gold, crude oil, and Treasury yields rose.

Stocks were mixed last Thursday with the Dow, the S&P 500, and the Russell 2000 posting gains, while the Nasdaq and the Global Dow fell. Crude oil prices fell, the dollar was mixed, and Treasury yields surged. As expected, Federal Reserve Chair Jerome Powell indicated that the Fed would continue its accommodative measures and allow the economy to expand essentially without reins until it nears the Fed’s 2.0% target rate for inflation. Financials, real estate, and health care performed well on the day, while communications, tech, and energy lagged.

Last week ended on a high note for stock indexes. The Dow and the Nasdaq advanced 0.6%, respectively last Friday. The S&P 500 gained 0.7% to reach an all-time high for the sixth consecutive trading session. The Russell 2000 climbed 0.9% on the day, and the Global Dow climbed 0.7%. Crude oil prices declined on the day, and the dollar fell to its lowest level in nearly two years.

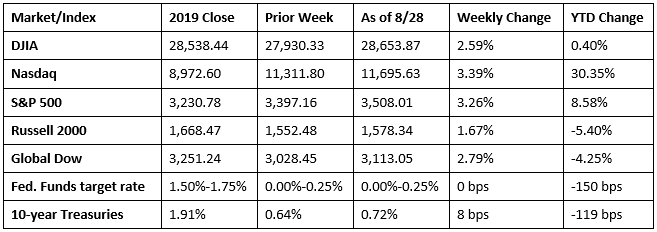

For the week, each of the benchmark indexes posted solid gains, led by the Nasdaq, and followed by the S&P 500, the Global Dow, the Dow, and the Russell 2000. Investors were buoyed by optimism about COVID-19 treatments and vaccines, assurances that the Federal Reserve will continue its accommodative stance, low interest rates, and muted inflation. Year to date, the Dow finally passed its 2019 closing value, joining the Nasdaq and the S&P 500.

Crude oil prices ended the week at $42.97 per barrel by late Friday afternoon, up from the prior week’s price of $42.29. The price of gold (COMEX) increased last week, closing at $1,972.80, up from the prior week’s price of $1,946.20. The national average retail price for regular gasoline was $2.182 per gallon on August 24, $0.016 higher than the prior week’s price but $0.392 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The second estimate of gross domestic product for the second quarter decreased at an annual rate of 31.7%, according to the second estimate released by the Bureau of Economic Analysis. GDP decreased 5.0% in the first quarter. The second estimate is slightly better than the advance estimate (-32.9%). The decrease in GDP reflected decreases in personal consumption expenditures, exports, nonresidential (business) fixed investment, private inventory investment, residential fixed investment, and state and local government spending that were partly offset by an increase in federal government spending. Imports, which are a subtraction in the calculation of GDP, decreased. Consumer prices fell 1.8% in the second quarter. Corporate profits decreased by $227 billion in the second quarter, compared with a decrease of $276 billion in the first quarter.

- Inflation, as measured by prices for consumer goods and services, advanced 0.3%, in July and is up only 1.0% over the last 12 months. Personal income grew by 0.4% in July, and disposable (after-tax) income climbed 0.2%. Consumer spending rose by 1.9% in July following a 6.2% surge in June as businesses continue to reopen from the shutdown resulting from the pandemic.

- Sales of new single-family homes followed a strong June with an equally strong July, advancing 13.9% for the month. New home sales are 36.3% above the July 2019 estimate. The median sales price of new houses sold in July 2020 was $330,600. The average sales price was $391,300. There was a four-month supply of inventory in July based on the current sales pace.

- New orders for durable goods surged in July, advancing 11.2% following June’s 7.7% increase. Excluding transportation, new orders increased 2.4%. Excluding defense, new orders increased 9.9%. Transportation equipment, up for three consecutive months, led the increase, gaining 35.6%. Nondefense new orders for capital goods in July increased 10.2%. New orders for defense aircraft and parts vaulted 77.1% in July.

- The international trade in goods deficit expanded by $8.3 billion, or 11.7%, in July from June. In July, exports increased by $12.2 billion, or 11.8%. Imports exceeded June’s total by $20.5 billion, or 11.8%.

- For the week ended August 22, there were 1,006,000 new claims for unemployment insurance, a decrease of 98,000 from the previous week’s level, which was revised down by 2,000. According to the Department of Labor, the advance rate for insured unemployment claims was 9.9% for the week ended August 15, a decrease of 0.2 percentage point from the prior week’s rate. The advance number of those receiving unemployment insurance benefits during the week ended August 15 was 14,535,000, a decrease of 223,000 from the prior week’s level, which was revised down by 86,000.

Eye on the Week Ahead

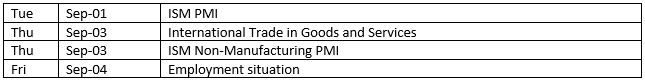

Important economic reports focusing on manufacturing, trade, and employment are out this week. Purchasing managers reported that manufacturing advanced in July for the first time in several months. August should show continued progress. The goods and services trade deficit was smaller in June than in the prior months. The July trade deficit is expected to expand further. There were nearly 1.8 million new jobs added in July. August’s figures may not be as robust.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.