The Nasdaq opened the week by reaching a new high last Monday after climbing for the ninth straight day. Otherwise, stocks tumbled, as the rapid rise in COVID-19 cases had investors worried that more restrictions might be forthcoming. The Global Dow and the Dow each fell 0.5%, followed by the S&P 500 (-0.2%) and the Russell 2000 (-0.1%). Communication, technology, and utilities were the only sectors to gain ground. Treasury yields and crude oil prices declined, while the dollar was mostly higher.

Positive news on fiscal stimulus talks and COVID-19 vaccines helped drive stocks higher last Tuesday. The Russell 2000 notched a gain of 1.4% on the day, followed by the Nasdaq (0.5%), the Dow (0.35%), and the S&P 500 (0.3%). The Global Dow fell 0.2%. Crude oil prices and the dollar rose, while Treasury yields sank. Sectors driving the market higher included energy, consumer staples, health care, and materials.

The promising rhetoric on fiscal stimulus that helped drive stocks higher last Tuesday was replaced by an apparent deadlock among lawmakers on Wednesday. Several of the largest tech companies saw their stock plunge following a massive sell-off by investors. The Nasdaq, which fell nearly 2.0%, suffered its worst day in a month. The S&P 500 and the Russell 2000 lost nearly 1.0% on the day, while the Dow dropped 0.4%. The Global Dow avoided a tumble, gaining 0.1%. Treasury bond prices fell driving yields higher. Crude oil prices dipped, while the dollar advanced.

Stocks were mixed last Thursday with the Nasdaq and the Russell 2000 posting gains, while the Dow and the S&P 500 fell. The Global Dow broke even by the end of the day’s trading. A spike in the number of jobless claims didn’t help investor confidence. Among the sectors, energy surged, with financials and information technology eking out minimal gains. Crude oil prices rose, while Treasury yields and the dollar fell.

Equities closed generally lower last Friday with only the Dow posting a modest 0.2% gain. The Global Dow (-0.7%), the Russell 2000 (-0.6%), the Nasdaq (-0.2%), and the S&P 500 (-0.1%) each lost value by the close of Friday’s trading. Crude oil prices and Treasury yields fell, while the dollar was mixed. A few of the market sectors advanced led by communication services (1.2%), consumer staples (0.3%), industrials (0.2%), and utilities (0.2%). Energy and financials fell nearly 1.0%.

Stocks closed generally lower for the week, led by the Global Dow, followed by the S&P 500, the Nasdaq, and the Dow. The small caps of the Russell 2000 posted a notable gain of more than 1.0% for the week. Investors got mixed messages on progress toward more fiscal stimulus, and concerns about the availability of a COVID-19 vaccine weighed on investors. Year to date, the Nasdaq remains well ahead of last year’s pace, followed by the Russell 2000, the S&P 500, the Global Dow, and the Dow.

Crude oil prices advanced again last week, closing at $46.58 per barrel by late Friday afternoon, up from the prior week’s price of $46.04 per barrel. The price of gold (COMEX) closed at $1,842.90 last week, up from the prior week’s price of $1,840.40. The national average retail price for regular gasoline was $2.156 per gallon on December 7, $0.036 higher than the prior week’s price but $0.405 less than a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- The Consumer Price Index increased 0.2% in November after being unchanged in October. Over the past 12 months, the CPI increased 1.2%. Last month, food prices fell 0.1%, and prices for used cars and trucks dipped 1.3%. Energy prices rose for the sixth consecutive month, after climbing 0.4% in November. Energy prices were driven by a 3.6% surge in fuel oil prices. Also climbing higher were prices for utility (piped) gas service (3.1%), transportation services (1.8%), apparel (0.9%), and electricity (0.5%).

- Prices that producers received for goods and services advanced 0.1% in November after climbing 0.3% in October. Producer prices increased 0.8% for the 12 months ended in November, the largest increase since moving up 1.1% for the 12 months ended in February. Prices less foods, energy, and trade services advanced 0.1% in November, the seventh consecutive monthly increase. For the 12 months ended in November, prices less foods, energy, and trade services moved up 0.9%, the largest rise since a 1.0% increase for the 12 months ended in March. In November, prices for goods rose 0.4%, driven by a 1.2% increase in energy prices. Producer prices for services were unchanged in November.

- The government deficit came in at a lower-than-expected $145 billion in November, well below the November 2019 deficit of $209 billion. However, the deficit for the first two months of the 2021 fiscal year is 25% greater than the same period last fiscal year. Government expenditures for fiscal year 2021 were 9% higher, while receipts were 3% lower than last year’s totals.

- There were 6.7 million job openings in October, according to the latest Job Openings and Labor Turnover Summary. This represents an increase of 200,000 job openings from September’s total. Job openings increased in health care and social assistance, and state and local government education. Job openings decreased in a number of industries, with the largest decreases in retail trade, accommodation and food services, and finance and insurance. The number of hires in October, at 5.8 million, was little changed from the previous month. The number of total separations increased by roughly 300,000 to 5.1 million in October. Over the 12 months ended in October, hires totaled 70.4 million and separations totaled 76.1 million, yielding a net employment loss of 5.7 million.

- For the week ended December 5, there were 853,000 new claims for unemployment insurance, an increase of 137,000 from the previous week’s level, which was revised up by 4,000. According to the Department of Labor, the advance rate for insured unemployment claims was 3.9% for the week ended November 28, an increase of 0.1 percentage point from the prior week’s rate. For comparison, during the same period last year, there were 237,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended November 28 was 5,757,000, an increase of 230,000 from the prior week’s level, which was revised up by 7,000. The highest insured unemployment rates in the week ended November 21 were in Alaska (6.3%), California (6.3%), New Mexico (6.1%), Nevada (6.0%), Hawaii (5.6%), Massachusetts (5.1%), the District of Columbia (5.0%), and Illinois (5.0%). The largest increases in initial claims for the week ended November 28 were in Illinois (+8,535), Oregon (+5,461), Colorado (+1,905), Indiana (+1,746), and Louisiana (+1,735), while the largest decreases were in California (-37,803), Texas (-14,123), Michigan (-10,976), Georgia (-9,905), and Washington (-7,881).

Eye on the Week Ahead

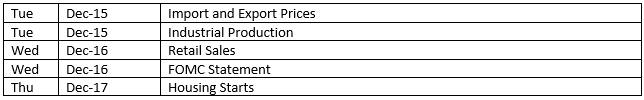

The Federal Open Market Committee meets this week. The Committee is not expected to alter the current federal funds rate range. The Federal Reserve’s report on industrial production for November is also out this week. October saw industrial production increase 1.1%, however production in total has yet to reach its pre-pandemic level from February.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2020 Broadridge Financial Solutions, Inc. All Rights Reserved.