Last Monday, stocks began the new year down on worries over the Georgia runoff elections, a surge in COVID-19 cases, and evidence that a new strain of the virus has entered the country. The S&P 500, the Nasdaq, and the Russell 2000 each fell 1.5%. The Dow declined 1.3% and the Global Dow dropped 0.5%. Treasury yields and the dollar were mixed, and crude oil prices fell. Some sectors took heavy losses last Monday, including real estate, utilities, industrials, information technology, communication services, and financials.

Stocks recovered last Tuesday, spurred by cyclicals and small caps. The Russell 2000 led the surge, advancing 1.7%, followed by the Nasdaq (1.0%), the Global Dow (0.9%), the S&P 500 (0.7%), and the Dow (0.6%). Treasury yields and crude oil prices rose, while the dollar slipped. Most of the market sectors gained, with energy posting the largest advance, climbing 4.5% on the day.

Wednesday was a day that will be remembered for the violence that took place at the United States Capitol and interrupted certification of the presidential election. Nevertheless, equities posted solid gains by day’s end, led by the small caps of the Russell 2000, which vaulted 4.0% on the heels of a 1.7% jump the prior day. Only the Nasdaq lost ground, falling 0.6% as tech shares lagged. The Global Dow advanced 2.1%, the Dow climbed 1.4%, and the S&P 500 rose 0.6%. The 10-year Treasury yield surpassed 1.0% for the first time since last March. Crude oil prices rose above $50 per barrel, while the dollar was mixed.

Last Thursday, stocks continued to advance, apparently unaffected by the events of the prior day. Investors pinned their hopes of a speedier economic recovery on additional stimulus and increased vaccines. The tech stocks of the Nasdaq recovered from Wednesday’s losses to post a solid 2.6% gain last Thursday. The small caps of the Russell 2000 continued to surge, advancing 1.9%, followed by the S&P 500 (1.5%), the Global Dow (1.0%), and the Dow (0.7%). The yields on 10-year Treasuries rose last Thursday, as did crude oil prices and the dollar. Information technology, consumer discretionary, energy, financials, and communication services were the top-performing sectors by the end of the day.

Last Friday proved to be another banner day for equities as each of the benchmark indexes posted gains, except for the small caps of the Russell 2000, which fell 0.3%. The Nasdaq jumped 1.0%, followed by the S&P 500 (0.6%), the Global Dow (0.3%), and the Dow (0.2%). Treasury yields, crude oil prices, and the dollar advanced. Consumer discretionary and real estate led the sectors.

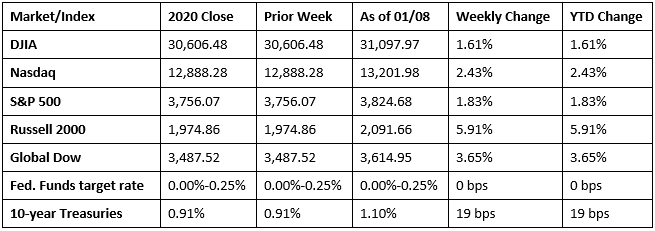

Stocks climbed to all-time highs last week as investors latched on to President-elect Joe Biden’s statement that he’d push for trillions of dollars in further aid and stimulus. The market’s strong performance came despite a poor jobs report for December (see below), which highlighted the impact of surging COVID-19 cases while adding incentive for more stimulus. By the end of last week, the Russell 2000 gained nearly 6.0%, followed by the Global Dow, the Nasdaq, the S&P 500, and the Dow. Crude oil prices pushed above $50 per barrel after climbing more than 8.5% for the week. The dollar inched up by a quarter of a percent, while gold prices fell by the end of the week.

The national average retail price for regular gasoline was $2.249 per gallon on January 4, $0.006 higher than the prior week’s price but $0.329 less than a year ago. The highest regular gas prices on January 4 were in California ($3.10), Massachusetts ($2.22), and New York ($2.21).

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week’s Economic News

- For the first time since April, employment decreased in December. According to the Bureau of Labor Statistics, total employment declined by 140,000 last month. Both the unemployment rate, at 6.7%, and the total number of unemployed persons, at 10.7 million, remained unchanged. The decline in employment reflects the recent increase in COVID-19 cases and efforts to contain the pandemic. Although both measures are much lower than their April highs, they are nearly twice their pre-pandemic levels in February (3.5% and 5.7 million, respectively). The labor force participation rate and the employment-population ratio were both unchanged over the month, at 61.5% and 57.4%, respectively. These measures are up from their April lows but are lower than in February by 1.8 percentage points and 3.7 percentage points, respectively. In December, the number of persons not in the labor force who currently want a job, at 7.3 million, was little changed over the month but is 2.3 million higher than in February. Last month, 23.7% of employed persons teleworked because of the pandemic, up from 21.8% in November. December also saw 15.8 million persons report that they had been unable to work because their employer closed or lost business due to the pandemic. The average work week declined by 0.1 hour to 34.7 hours in December. Average hourly earnings increased by $0.23 to $29.81 last month. Average hourly wages increased 5.1%, or $1.44 since December 2019.

- According to the latest Manufacturing ISM® Report On Business®, manufacturing increased in December. The purchasing managers’ index registered 60.7% last month, 3.2 percentage points above the November reading. The December PMI® indicates expansion in the overall economy for the eighth month in a row after contracting in March, April, and May. Also advancing in December were new orders, production, employment, and prices. New export orders and imports decreased last month.

- Economic activity in the services sector also expanded in December, according to the latest Services ISM® Report On Business®. The purchasing managers’ index for services increased by 1.3% in December over November, marking the seventh consecutive monthly increase. Supplier deliveries, business activity and production, new orders, and inventories all increased last month. Employment and prices declined in December.

- According to the latest information from the Census Bureau, the international trade deficit rose by 8.0% in November, sitting at $68.1 billion. Exports were $184.2 billion in November, up 1.2% from the prior month. Imports were $252.3 billion, an increase of 2.9% in November over October. Year to date, the goods and services deficit increased $73.6 billion, or 13.9%, from the same period in 2019. Exports decreased $372.3 billion, or 16.1%. Imports decreased $298.7 billion, or 10.5%.

- For the week ended January 2, there were 787,000 new claims for unemployment insurance, a decrease of 3,000 from the previous week’s level, which was revised up by 3,000. According to the Department of Labor, the advance rate for insured unemployment claims was 3.5% for the week ended December 26, unchanged from the prior week’s rate. For comparison, during the same period last year, there were 212,000 initial claims for unemployment insurance, and the insured unemployment claims rate was 1.2%. The advance number of those receiving unemployment insurance benefits during the week ended December 26 was 5,072,000, a decrease of 126,000 from the prior week’s level, which was revised down by 21,000. States and territories with the highest insured unemployment rates in the week ended December 19 were in Puerto Rico (7.8%), Alaska (6.4%), California (6.0%), Kansas (5.9%), Nevada (5.6%), Illinois (5.5%), New Mexico (5.5%), Pennsylvania (5.2%),Washington (5.1%), and the District of Columbia (4.6%). The largest increases in initial claims for the week ended December 26 were in New York (+10,318), California (+10,071), Kentucky (+4,341), Missouri (+4,105), and New Jersey (+2,851), while the largest decreases were in Illinois (-34,568), Pennsylvania (-9,026), Georgia (-7,713), Kansas (-3,710), and Texas (-3,531).

Eye on the Week Ahead

December’s inflation indicators are out this week. The Consumer Price Index, which advanced 1.2% in 2020, isn’t expected to advance more than the November rate of 0.2%. Producer prices rose by only 0.8% last year and 0.1% last November. The retail sales report for December is also available this week. November saw retail sales fall 1.1%. However, the holiday shopping season should push retail sales up in December.

The Week Ahead

The information provided is obtained from sources believed to be reliable. Forecasts cannot be guaranteed. Past performance is not a guarantee of future results.

© 2021 Broadridge Financial Solutions, Inc. All Rights Reserved.